PETS International recently dug into 50 #petindustry investments spanning January to September 2025—and the results tell a compelling story. Even amid a macroeconomic landscape tangled with uncertainty, US tariffs, geopolitical tensions, and rising inflation, mergers and acquisitions (M&A) in the pet space have stayed positive. Venture capital and private equity firms haven’t hit pause; instead, they’ve doubled down on negotiations, paired with strategic vertical and horizontal acquisitions.

Going Against the Grain

This activity bucks the broader market trend. PwC’s 2025 mid-year outlook notes a 9% drop in overall deal volume during the first half—but a 15% jump in deal values. Of the deals PETS International analyzed, only 4 disclosed their values: one topped $1.5 billion (€1.3B), while the other three ranged from $13 million (€11M) to $62 million (€53M). The picture is fragmented in terms of size, with smaller transactions taking center stage—mostly for geographic expansion or portfolio growth.

Pet Food Takes the Lead

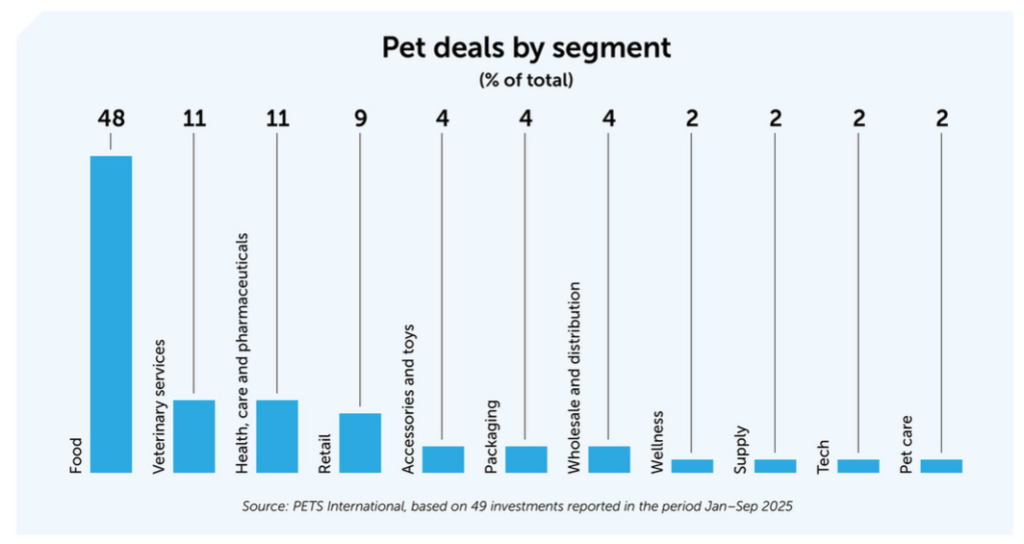

Nearly half of the top M&A deals in the first nine months focused on #petfood—including nutrition and treats. A standout player here is Sweden-based The Nutriment Company, which snapped up eight strategic and family-owned businesses across the UK, Germany, Spain, and France. Their goal? Capitalize on Europe’s booming raw food trend and growing cat population.

Garyth Stone, Managing Director at Houlihan Lokey’s Consumer Group, credits the industry’s “strong fundamentals” for this momentum. “It’s not about more pets—it’s about more spending per pet,” he told PETS International. Today’s #petparents, especially a new generation focused on quality, are driving demand for higher-end, higher-margin products—and that’s fueling deal activity in the food space.

Growing Segments to Watch

Fresh pet food is having a moment, driven by a mix of opportunity and caution. “Big companies aren’t sure how big this segment will get, so they’re leaning into acquisitions instead of building from scratch,” explains Andrea Binder, Pet Industry Thought Leader at NielsenIQ.

Next up: veterinary services, #pethealth, and pharmaceuticals. Skyrocketing vet bills are pushing companies to offer more affordable options, spurring deals in this space. Science-backed supplements are also hot—they’re one of the few categories growing in physical stores right now. “Manufacturers are investing in supplement brands instead of doing all the research themselves,” Binder adds. “Consumers care deeply about that scientific backing today.”

Examples abound: Malmö-based Swedencare bought British firm Summit Veterinary Pharmaceuticals for £30 million ($39M/€36M) in March, while US retailer Tractor Supply entered the online pharmacy space by acquiring Allivet in January.

Retail’s Focus: Efficiency & Scalability

Retail makes up 9% of the investments reviewed, with most deals tied to local distributors. The focus? Scalability and omnichannel strategies. Gilles Vanhouwe, Director at Brussels-based Verlinvest, says #pet

retail “still appeals to investors thanks to consolidation potential.”

Case in point: Bulgarian retailer Petmall merged with its distributor Petfoodtrade in January to boost local market efficiency. In the Middle East, Dubai’s Pet Corner expanded to Abu Dhabi by acquiring fellow retailer Jungle Paws. Even so, Vanhouwe notes, “many are waiting for a bigger catalyst to unlock more activity.” Direct-to-consumer brands are maturing (like Katkin breaking into retail), and roll-up platforms such as Nutriment and AlphaPet are emerging as serious players.

Other Sectors with Smaller Footprints

Deals in other areas are less frequent but notable: accessories and toys (4%), packaging (4%), wholesale and distribution (4%), plus wellness, supply, services, and tech (2% each). A highlight in pet tech? GPS tracking and health monitoring platform Tractive acquired Mars subsidiary Whistle. Vanhouwe also flags grooming, specialty retail, and pet pharma/wellness as “strong growth pockets” to watch.

Europe Leads Consolidation

Europe dominates the M&A landscape, accounting for 67% of major deals—mostly in pet food and care. Stone explains that M&A activity moves in waves: the premiumization trend that took hold in the US years ago arrived later in Europe and took longer to consolidate. “Companies need to reach a certain scale before they become M&A targets,” he says.

North America is next with 17% of deals, spanning beyond food to wellness, veterinary services, and pharma. US firm Central Garden & Pet has also named M&A as a key strategy to bounce back from early-year net sales declines.

What These Deals Reveal About the Pet Industry’s Future

Looking at 2025’s investment trends, a few clear patterns emerge—ones that will shape the industry for years to come:

First, quality over quantity is non-negotiable. Pet parents are willing to spend more on premium, science-backed products (from raw food to supplements), and investors are betting big on brands that deliver that value.

Second, segment specialization is key. Instead of broad, one-size-fits-all brands, we’re seeing growth in niche areas—fresh food, affordable vet care, targeted supplements—that solve specific pet parent pain points.

Third, consolidation is heating up—especially in Europe. As smaller, regional players scale, they’re becoming attractive targets for larger firms looking to expand their footprint or product lines.

Finally, efficiency and adaptability matter—whether it’s a retailer merging with a distributor to streamline operations or a brand acquiring a supplement company to skip years of research. In a volatile macroeconomy, agility and focus on core strengths are what’s driving successful deals.

As Vanhouwe notes, “Larger deals are expected late 2025 into early 2026”—and their outcomes will set the tone for the next cycle of pet industry M&A. For brands and investors alike, the takeaway is clear: doubling down on what pet parents (and their furry friends) truly need—quality, convenience, and care—will keep the momentum going.

What’s one trend you think will define the next wave of pet industry growth? Let us know in the comments!

Source: GlobalPETS