In many parts of the world it seems clear that new strategies are needed to retain customers and persuade them to be brand – loyal in the face of stiff competition.

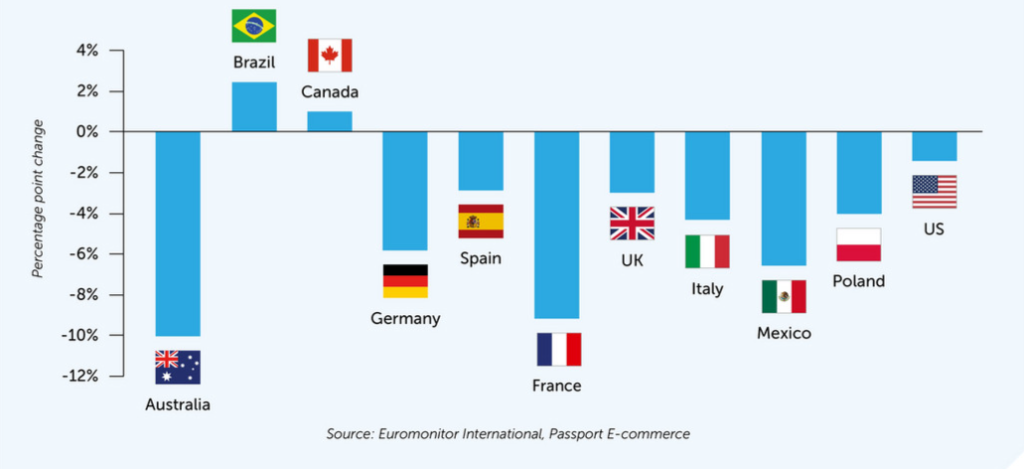

Online pet specialists are classified in the Euromonitor e – commerce database as ‘home products specialists’. Currently, they are losing market share to groceries, marketplaces or both. How strong this trend is depends on the market, but the channel isn’t performing well anywhere.

Regional differences

In the US, the biggest global market for online pet care, the online channel lost 1.4 percentage points between 2022 and 2024, with groceries and direct – to – consumer (DTC) emerging as the main winners. This analysis is based on the online shopping behavior of 24 million panelists worldwide.

Some countries, for example Brazil and Canada, have managed to maintain and slightly grow their percentage share of the market. France, meanwhile, is seeing one of the strongest negative shifts in the channel, with pet specialists losing 9 percentage points between 2022 and 2024.

Carrefour integrates specialist into grocery

French grocery giant Carrefour is one of the companies that has contributed to the channel shift in the country by, perhaps grudgingly, redirecting all shopper traffic from its online pet specialist Croquetteland to its site carrefour.fr since early 2024.

For a while, the specialist’s logo lived on as a separate section in the Carrefour category tree, but it has since disappeared via a merger into a general pet section.

While this merger introduces the option for consumers to buy their #petbrands such as Royal Canin alongside their weekly groceries, the retailer mainly focuses on its Carrefour private label and other typical grocery brands.

Share change for home product specialists in pet care online (2024 vs 2022)

This was not the original idea when it acquired a majority stake in the pet specialist in 2016. A year later, Pascale Barbot, responsible for the development of Croquetteland at Carrefour, alluded to the 33.5 billion (€3.28) acquisition of Chewy by PetSmart in the US while explaining how he was planning to make the Croquetteland site an important player in #petfood that consumers would always consider.

Switching to economy brands

When a consumer switches from online pet specialists to online grocery, that also indicates a switch from premium brands such as Hill’s Pet Nutrition, Royal Canin and Pro Plan to economy brands such as Pedigree and Whiskas. If anything, therefore, the move from online pet specialists to online grocery appears to be driven by frugality on the side of consumers, in a business that has historically been resilient to economic crises.

Promoting subscriptions for loyalty

While it’s not too late, pet specialists would benefit from getting more consumers into money – saving subscription deliveries of the brands their pets already like to once. Once pet owners successfully trade down, bringing them back to the premium brands will be an expensive task.

Independently from pet specialists, strong brands can forward integrate online by launching their own DTC stores. Creating a direct link to its most loyal customers enables a brand to retain them through long-term low prices, while also harvesting data.

Zoomaalia’s strategy for success

Zoomaalia is an exceptional case among online pet specialists, with a stellar growth performance in the last 3 quarters of 2024. During that time, it lifted the home product specialist channel in France and took 4 percentage points from Amazon, Carrefour and Leclerc Drive.

There are several components to Zoomaalia’s recent success in activating the increased discretionary spending power of consumers in the light of falling interest rates. The company is a local specialist, deriving most of its revenue in France. It also uses automation and technology to estimate just the right time to suggest a repeat order to consumers, as replenishments make up about 50% of its total revenue.

If an online pet specialist reactivates customers with a call to replenish too early, its email is ignored. However, should the consumer run out of feed, they’ll go to a physical store for an immediate refill. But if the call to replenish – with a suitable discount – comes at just the right time, success is very likely. Zoomaalia was recently voted Grand Prix Malltelier E – commercant de l’Année 2025 (best e – tailer) by recuitment specialist Conceptual Vendrea.

Finding opportunities for growth

In Canada, where the online pet specialist channel is growing, Pet Valu is the big winner. Its main competition PetSmart had a decent 2024 overall, but didn’t manage to take market share, according to the latest Euromonitor e – commerce data publication in January.

Meanwhile, US – based Chewy, split from PetSmart in 2020, has seen an opportunity to enter the Canadian #petcare market.

With its online pure play model in Canada, it hopes to gain market share and perhaps drive the home products specialist channel further, focusing on automated replenishment suggestions and subscription revenue in the same way as Zoomaalia.

Source: Euromonitor International Passport E – commerce