With new tariffs as high as 40% starting in August, the regional economy is feeling the pressure.

The US Commerce Secretary recently underscored that although talks could still occur after 1 August, countries without an agreement by then will begin facing reciprocal tariffs from that date.

The Asian #petretail market is in a vulnerable position as some of the region’s leading exporters are now facing steep US tariff rates.

Tariffs to take effect

Countries such as South Korea and Malaysia facing rates of 25%. Others face even higher rates, including Bangladesh (35%), Cambodia and Thailand (36%) and Myanmar and Laos (40%).

Others, like Japan, have reached deals with the US to reduce tariffs. On 22 July 2025, the 2 countries agreed to a new trade deal that reduces Japanese import tariffs to 15%, thereby avoiding a planned 25% hike. The country also pledged $550 billion (€468.6B) in US investments and broader market access for American products like cars and rice.

On 15 July, the US finalized a deal with Indonesia, imposing a 19% tariff (down from 32%) on exports while granting tariff-free access to US goods. The agreement also includes major purchases of Boeing aircraft, as well as energy and agricultural products.

The US struck a similar deal with the Philippines on 22 July, setting a 19% tariff on exports and eliminating tariffs on American goods, alongside commitments to military cooperation and investment.

A preliminary agreement with Vietnam was announced on 2 July, applying a 20% tariff on Vietnamese imports and a 40% rate on transshipped goods, while the country agreed to open its market to US products duty-free.

Closing regional ties

The new wave of US tariffs may not only affect trade but also influence regional alignment.

The State of Southeast Asia Survey Report by the Singapore-based ISEAS–Yusof Ishak Institute shows that many Southeast Asian opinion leaders already favor closer ties with China over those with the United States.

The survey, conducted from January to February 2025 – before the imposition of reciprocal tariffs – asked respondents, including opinion makers and leaders in the Association of Southeast Asian Nations (ASEAN), which strategic rival they would choose if forced to align.

In countries most affected by the new US tariffs on #petproducts, the preference for China is pronounced. For instance, 72% of Indonesian respondents and 71% of Malaysians said ASEAN should align with China, while only 28% and 29%, respectively, favored the United States.

The divide is also notable in Thailand (56% for China), Cambodia (43%) and Laos (51%), all of which face tariffs of 36% or higher.

In contrast, Vietnam and the Philippines, 2 countries with historically stronger US ties, exhibit the opposite trend, with 74% and 86% of respondents, respectively, favoring alignment with the United States.

ASEAN is an intergovernmental international organization, comprising Indonesia, Vietnam, Laos, Brunei, Thailand, Myanmar, the Philippines, Cambodia, Singapore and Malaysia.

Level of trust

Trust in the US has grown collectively across the 10 ASEAN countries from 42.4% in early 2024 to 47.2% in early 2025, according to the ISEAS–Yusof Ishak Institute survey reported by Time.

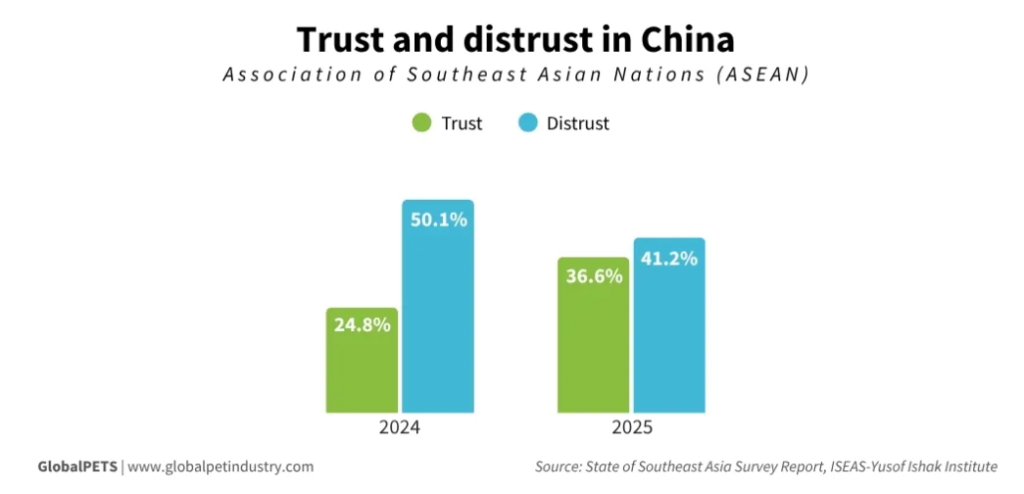

China has also seen its trust value grow across these countries, with 11.8% growth. However, distrust in the country still sits quite high at 50.1% this year, compared to an overall 41.2% in 2024.

Regional breakdown

Brunei has seen the most significant turnaround in the past year, with distrust in the US dropping from 61.1% in 2024 to 24.2% in 2025. Trust in the US now stands at 53.7%, up from just 16.9% the year before.

The Philippines continues to show high levels of trust in the US, although this has declined by 7.5% over the past year. Distrust currently sits at 20.4%, according to the research. Meanwhile, trust in China has slightly increased, rising from 69.4% to 71.1%.

A similar trend is observed in Vietnam, where trust in the US declined by 5.9% to 60.6%, while distrust dropped significantly—down 21% to 16.1%. However, distrust toward China has grown, increasing from 51% in 2024 to 56.6% in 2025.

Thailand’s trust in the US remains relatively stable at 44.4% in 2025. Trust in China, meanwhile, is close behind at 42.3%, although distrust has risen by 10% over the past year, now reaching 47.7%. Other countries facing higher tariffs, such as Cambodia and Malaysia, show mixed sentiments.

In Malaysia, distrust toward the US has slightly decreased—from 56.9% to 56.3%—with trust ticking up marginally to 23.3%, a 0.2% increase. Distrust in China, however, has risen to 40.5%, compared to 31.7% who express trust.

Cambodia has experienced an almost 10% increase in trust toward China, which now exceeds its distrust level of 37.8%. Regarding the US, trust has improved to 58.8%, up 2.2% from 2024. However, distrust has also grown, rising from 25.6% to 29.1%.

SOURCE:GLobaLPETS

2 Responses

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

Hello There. I found your blog the usage of msn. This is a very well written article. I’ll be sure to bookmark it and return to learn extra of your useful information. Thank you for the post. I’ll certainly return.