The European Pet Food Industry Federation (FEDIAF) recently released its annual 2025 European Pet Market Report at its yearly conference. This report was jointly compiled by 15 national #petindustry associations and analyzed by Soulor Consulting, covering 41 European countries—including all EU and EEA member states, as well as most Council of Europe member states (note: data on pets in Russia is not included in this report).

This comprehensive analysis provides unprecedented insights into #petownership trends, population distribution, and market dynamics across Europe. Below is a detailed breakdown of the report’s key findings, presented in full alignment with the original data sequence.

1. Overview of Pet Ownership Across Europe

Europe’s “pet economy” maintains steady growth, with nearly half of households keeping companion animals. The core data on pan-European pet ownership is as follows:

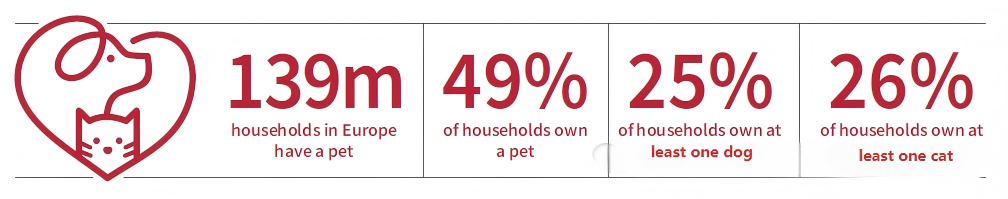

Core Indicators

- Total Number of Pet-Owning Households: 139 million, accounting for 49% of all households in Europe

- Total #PetPopulation: 299 million (if aquaria are excluded, the total is 282 million)

- Pet Preference Ratio: Cats are slightly more popular than dogs in Europe—26% of households own cats, while 25% own dogs

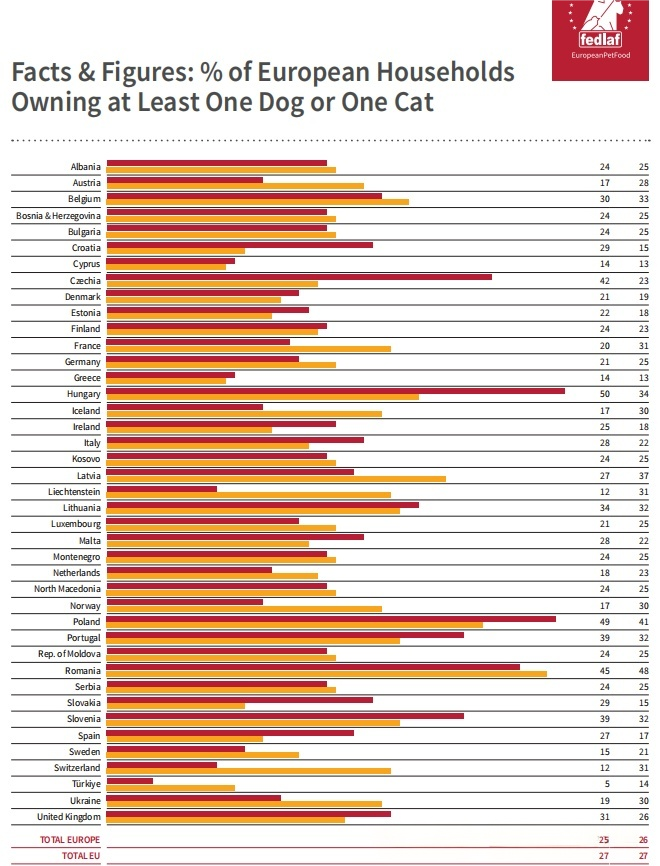

Countries with the Highest Pet Ownership Rates

Pet ownership rates vary significantly by country, with Central and Eastern European countries showing particularly high levels of pet ownership:

- Countries with the Highest Dog Ownership Rates: Hungary (50% of households own dogs), Poland (49%), Romania (45%)

- Countries with the Highest Cat Ownership Rates: Romania (48% of households own cats), Poland (41%), Latvia (37%)

- Notable Data: Both Hungary and Portugal have cat ownership rates exceeding 40%

2. Pet Population by Category and National Distribution

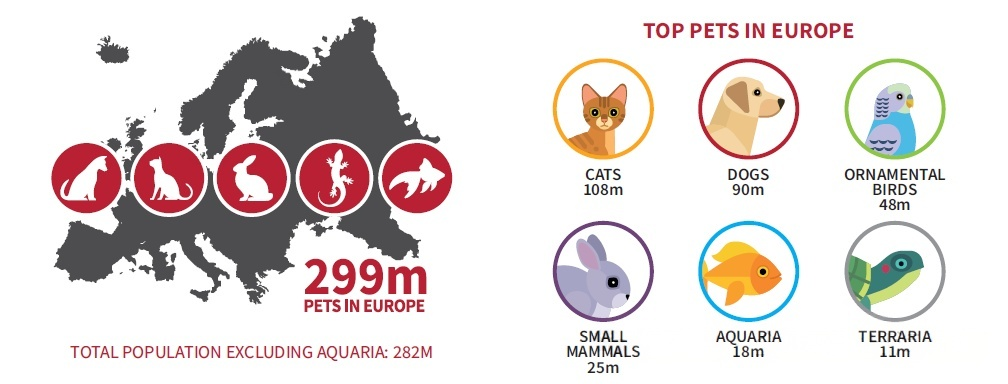

Europe’s 299 million pets are divided into six major categories, with distinct regional preferences influencing the distribution of different pet types.

Overall Pet Population Breakdown by Category

The six major pet categories and their respective populations are:

- Cats: 108 million (the most populous pet category in Europe)

- Dogs: 89.6 million

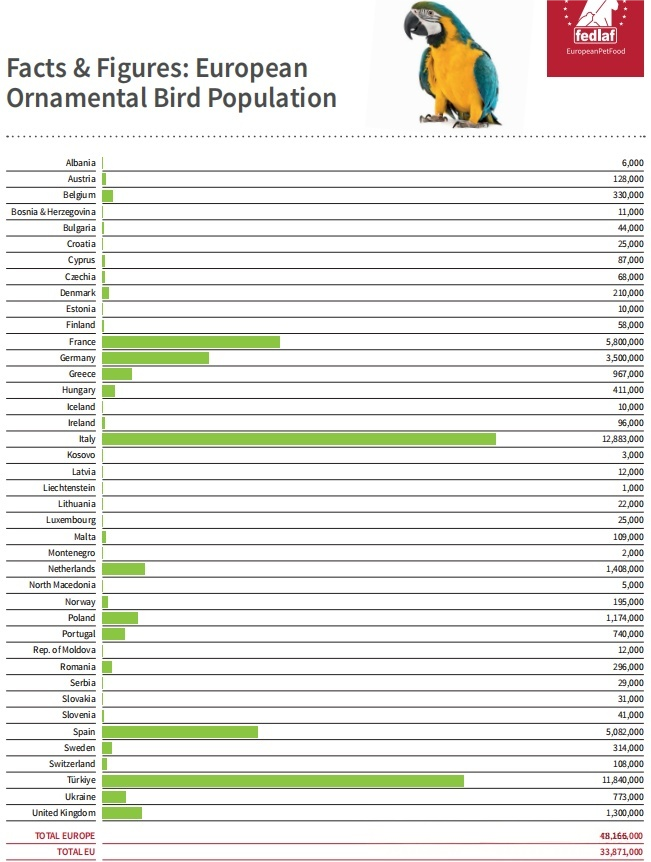

- Ornamental Birds: 48.2 million

- Small Mammals: 24.7 million

- Aquaria: 17.6 million (counted as units)

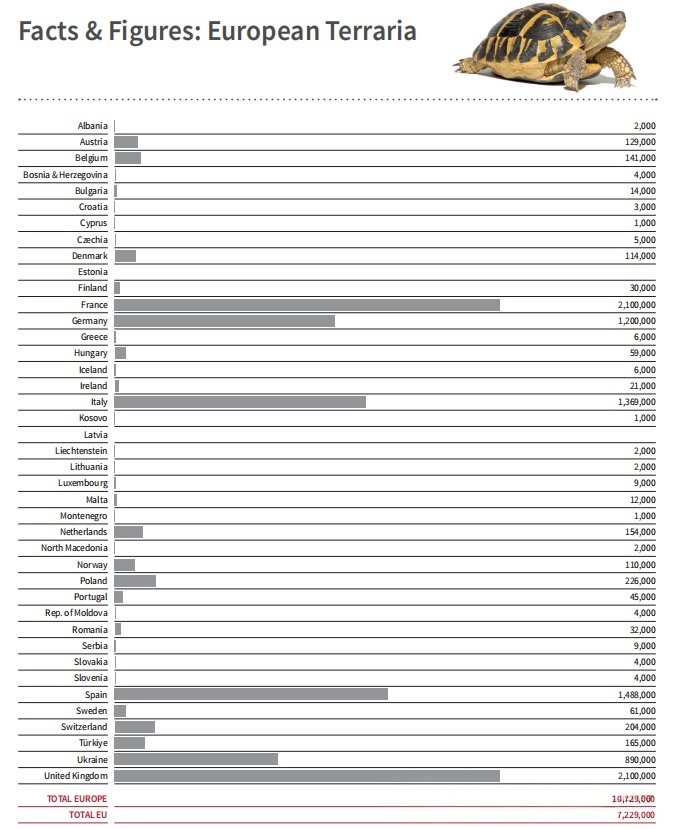

- Reptiles: 10.7 million (housed in terraria)

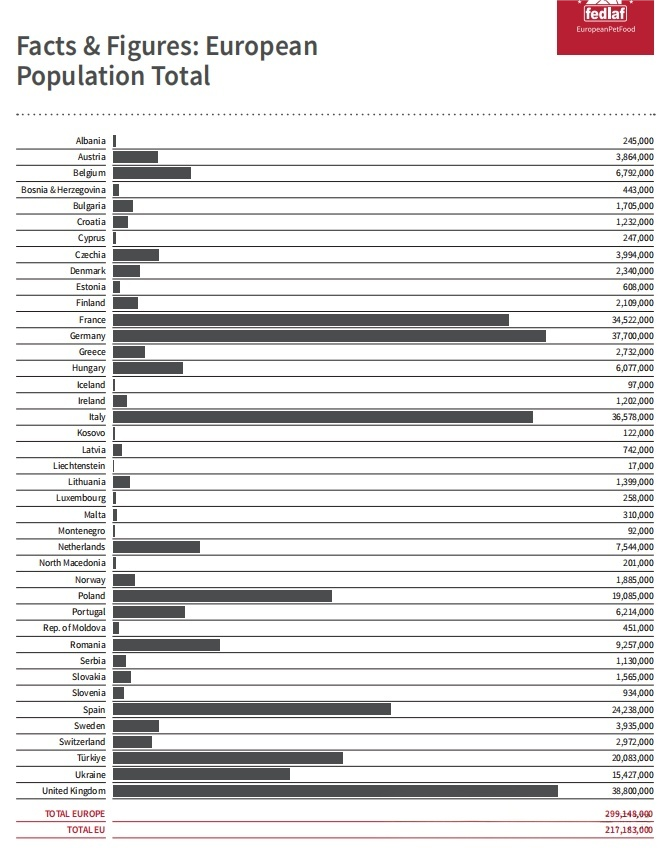

Top 5 Countries by Total Pet Population

When counting all pet categories, the countries with the largest total pet populations are:

- United Kingdom: 38.8 million

- Germany: 37.7 million

- Italy: 36.6 million

- France: 34.5 million

- Spain: 24.2 million

Note on Data Adjustment*: If aquaria are excluded from the count, the ranking of the top 5 countries by total pet population changes to:

- Germany: 35.5 million

- Italy: 35.1 million

- France: 33.3 million

- United Kingdom: 31.5 million

- Spain: 23.5 million

3. In-Depth Analysis: Europe’s Most Popular Pets – Cats and Dogs

Cats and dogs are the most widely kept pets in Europe, and there are clear leading countries for each in terms of population size.

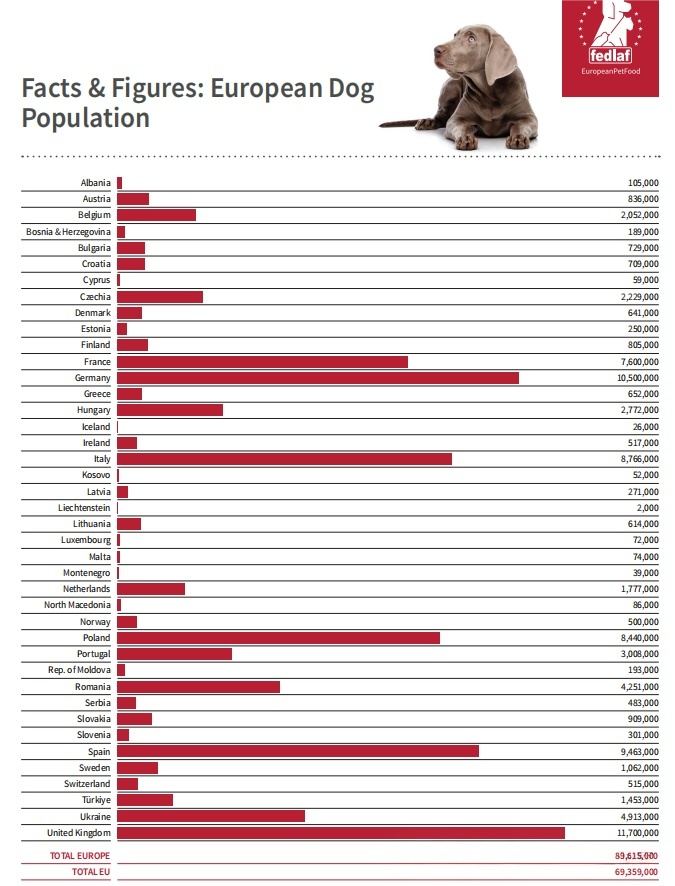

Dog Population (Total 89.6 Million)

The United Kingdom has the largest dog population in Europe, while breed preferences vary by region. The top 5 countries by dog population are:

- United Kingdom: 11.7 million (45% of these are rural dogs)

- Germany: 10.5 million (38% of these are medium to large-sized dog breeds)

- Spain: 9.5 million (small dog breeds are particularly popular here)

- Italy: 8.8 million (62% of these are urban dogs)

- Poland: 8.4 million

Interesting Fact*: France has the largest population of hunting dogs in Europe

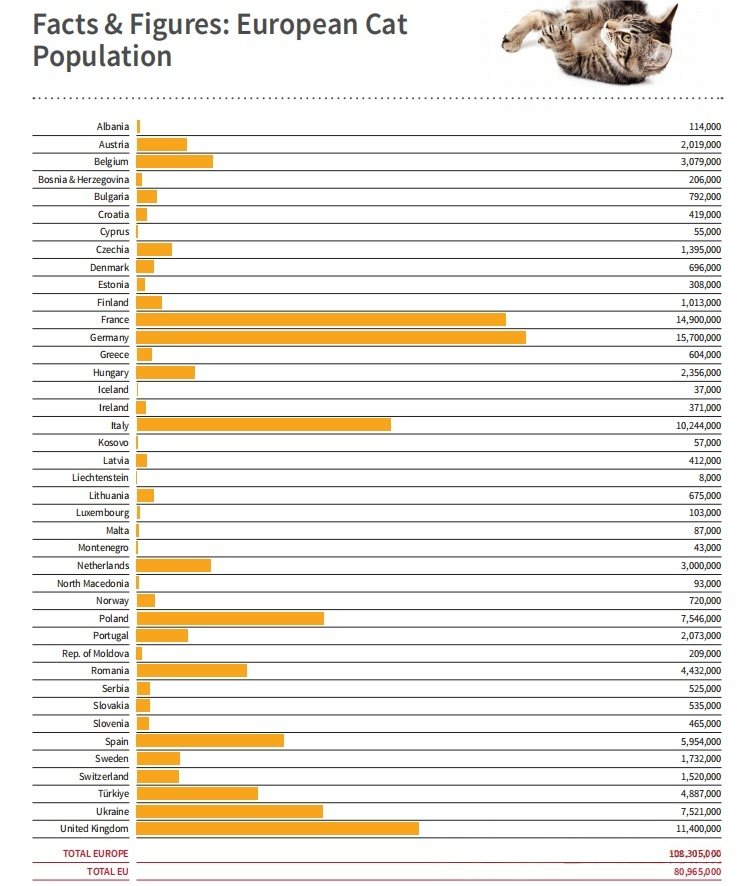

Cat Population (Total 108 Million)

Germany has the largest cat population in Europe, reflecting strong demand for cat-specific products in the country. The top 5 countries by cat population are:

- Germany: 15.7 million (the largest cat population in the EU)

- France: 14.9 million (25% of households in France own cats)

- United Kingdom: 11.4 million (over 70% of these are urban cats)

- Italy: 10.2 million (the average weekly consumption of wet cat food per cat is 3.2 cans)

- Poland: 7.5 million

4. Other Popular Pet Categories in Europe

Beyond cats and dogs, Europeans are increasingly keeping exotic pets and small companion animals, with obvious regional characteristics in pet preferences.

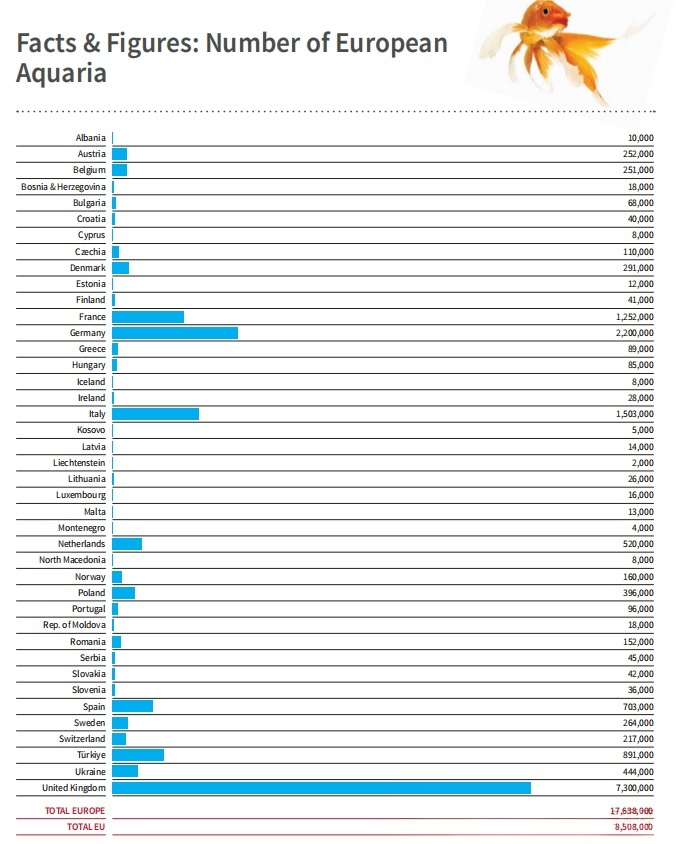

Aquaria (17.6 Million Units)

The United Kingdom leads Europe in terms of aquaria ownership, accounting for 41% of the total number of aquaria in Europe. The key data for major countries are:

- United Kingdom: 7.3 million (most are freshwater aquaria)

- Germany: 2.2 million (a leader in saltwater aquaria technology)

- Italy: 1.5 million (the penetration rate of aquaria among households is 28%)

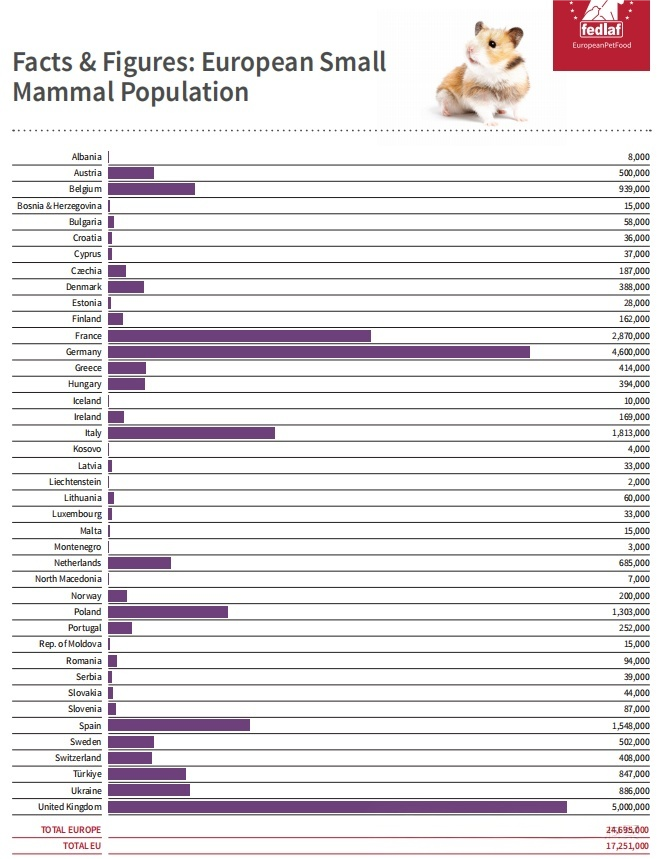

Small Mammals (24.7 Million)

Small mammals are especially popular in Western European countries. The key data for major countries are:

- United Kingdom: 5 million (70% are hamsters or rabbits)

- Germany: 4.6 million (the largest guinea pig breeding country in Europe)

- France: 2.9 million (demand for chinchillas is growing rapidly)

Ornamental Birds and Reptiles

- Ornamental Birds: The top 3 countries by population are France (5.8 million), Germany (3.5 million), and Hungary (967,000)

- Reptiles: The top 3 countries by population (counted by terraria units) are Spain (1.5 million), United Kingdom (2.1 million), and France (2.1 million)

5. Scale of Europe’s Pet Market and Consumer Trends

The growing pet population drives the continuous expansion of Europe’s pet market, with pet food and pet services being the core growth sectors.

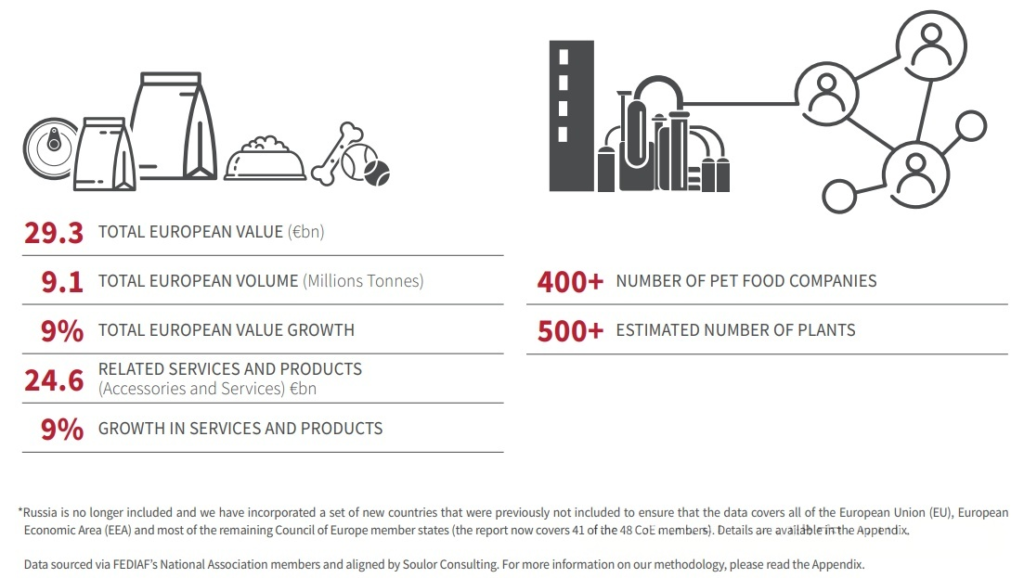

Market Scale

- Pet Food Market: The market value reaches €29.3 billion, with a total volume of 9.1 million tons, achieving a year-on-year growth rate of 9%. There are over 400 enterprises in the European pet food industry, with more than 500 production facilities.

- Pet Services and Related Products Market: The market value is €24.6 billion, with a year-on-year growth rate of 9%, covering pet healthcare, smart pet devices, pet grooming, and pet boarding services.

Top 5 Countries by Pet Food Market Size

The pet food market size varies by country, with the top 5 being:

- Germany: €6.2 billion (35% of products are high-end pet food)

- United Kingdom: €5.1 billion (functional pet treats achieve a 40% annual growth rate)

- France: €4.7 billion (the largest wet pet food market in Europe)

- Italy: €3.8 billion (the penetration rate of natural pet food is 28%)

- Spain: €2.5 billion (value-for-money pet food products dominate the market)

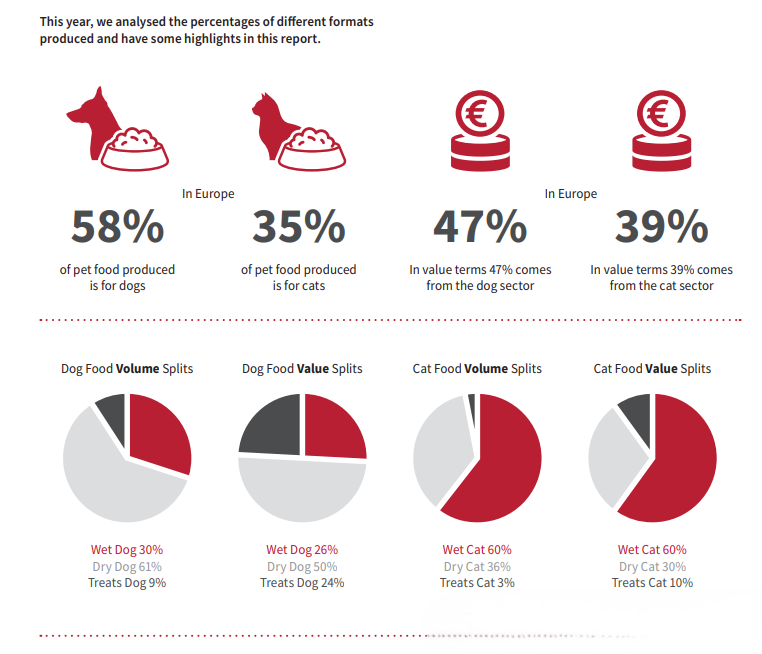

Breakdown of Pet Food Preferences

- Dog Food: Dry dog food accounts for 61% of the market volume (50% of the market value), wet dog food accounts for 30% of the market volume (26% of the market value), and dog treats account for 9% of the market volume (24% of the market value)—indicating that pet treats are high-margin products.

- Cat Food: Wet cat food dominates the market, accounting for 60% of both market volume and market value; dry cat food accounts for 36% of the market volume (30% of the market value); cat treats account for 3% of the market volume (10% of the market value)

6. Regional Characteristics of Europe’s Pet Market

Europe’s pet market is highly heterogeneous, with geographical location having a significant impact on both pet preferences and consumer spending power.

Regional Differences in Pet Preferences

- Southern Europe (Spain, Italy): Leads in the ownership of ornamental birds and reptiles

- Northern Europe and the United Kingdom: Dominates in the ownership of aquaria and small mammals

- Cat-Focused Markets (Germany, France): High consumption of cat food, especially wet cat food

- Dog-Focused Markets (United Kingdom, Poland): Drive innovation in functional dog snacks

Differences in Consumer Spending Power

- Western Europe (Germany, United Kingdom): Mature pet markets, with high-end pet food accounting for over 30% of the market; Germany has the highest per-pet annual spending at €164

- Eastern Europe (Turkey, Hungary): Emerging pet markets, with 70% of spending going to basic pet food; Turkey has the lowest per-pet annual spending at €32

- Nordic Countries (Sweden): 35% of pet-related spending goes to pet services; high demand for organic pet food and smart pet devices

High-Growth Markets

11 Central and Eastern European countries (including Albania and Bosnia and Herzegovina) have an annual growth rate of 5.2% in their pet markets—twice the growth rate of Western European markets—making them key target markets for expansion.

Final Thoughts: Opportunities for Global Exporters

Europe’s pet market, with 299 million pets and a combined market size of €53.9 billion (pet food + pet services), offers huge opportunities for global enterprises. However, to succeed in this market, enterprises need to pay attention to the following key points:

- Product Localization: Adjust product portfolios according to regional preferences—for example, developing wet cat food for the German market, functional dog treats for the UK market, and cost-effective basic pet food for Eastern European markets.

- Regulatory Compliance: Strictly abide by the EU’s Pet Food Directive, which sets strict standards for the nutrition and hygiene of imported pet products.

- Focus on High-Growth Segments: Target fast-growing product categories, such as smart pet devices (popular in Nordic countries), organic pet food (popular in Western Europe), and exotic pet supplies (popular in Southern Europe).

For any enterprise looking to enter the European pet market, aligning products with local consumption habits while meeting regulatory requirements will be the key to unlocking the potential of this large and diverse market.