The American Pet Products Association (APPA)’s 2025 Dog & Cat Report reveals major shifts in the #petfood and #petproducts industry—driven largely by the behaviors of Gen Z and millennial #petparents.

Based on Q4 2024 data, the report draws insights from a national survey of dog and cat owners. It highlights five critical trends reshaping the industry: the rise in cat ownership, deeper bonds between dogs and their owners, growing demand for premium functional pet food, a surge in proactive healthcare via supplements, and actionable takeaways for brands.

Trend 1: The “Year of the Cat” & The Rise of “Cat Dads”

Everyone in the pet food industry knows it: Cat ownership is on the rise—and with it, demand for cat food and cat-specific products. This trend shows no signs of slowing.

- Cat-Owning Households: This year, U.S. households with cats will hit 49 million—up 23% from 40 million in 2023.

- Key Drivers: Gen Z and millennial men are leading this shift. “Last year, Gen Z ‘cat dads’ increased by nearly 20%, and millennial cat dads by almost 25%,” the report notes.

It’s not just single-cat households growing, either. Since 2018:

- Single-cat households have dropped by 9%.

- Households with two cats are up 8%.

- Households with three or more cats have jumped by 36%.

This shift is a goldmine for pet food makers—more cats per household means more spending per customer.

Cat owners are also deepening their bonds with their feline friends, seeking products that foster connection:

- Cat Training: 48% of cat owners use some form of training—up 41% from 2018. This is reflected in rising sales of cat harnesses, safety belts, and collars.

- Cat Celebrations: 21% of owners throw holiday or birthday parties for their cats—a 250% surge since 2018.

- Themed Merch: 34% buy cat-themed products—an 89% increase from 2018.

For today’s cat owners, making sure their cats live their best lives is a top priority—and their purchasing choices show it.

Trend 2: Building Deeper Connections with Dogs

Much like cat owners, dog parents are integrating their pets into every part of life—seeking shared experiences and stronger bonds.

- Daily Walks: 53% of dog owners take their pups on walks for daily activities at least once a week—up 6% from 2023.

- Travel: 87% of dog owners have taken their pets on car trips. Even more notable: 74% have flown with their dogs—up 68% from 2023.

- Workplace Inclusion: Nearly half (49%) of dog owners say they’d “very likely” or “somewhat likely” bring their dogs to work if allowed—signaling strong demand for more pet-friendly workplaces.

Trend 3: The Boom in Premium Functional Nutrition

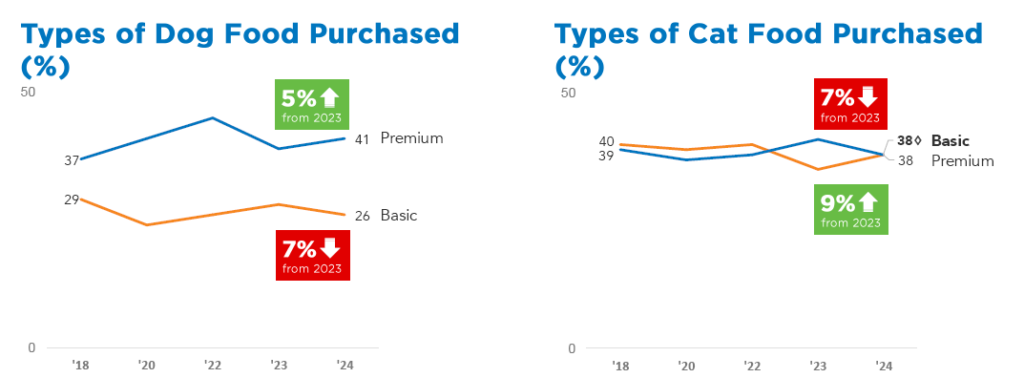

The report highlights a major comeback for premium #petnutrition—especially functional products (think pet food, treats, supplements, and toppers). After facing headwinds from economic uncertainty, premium pet food rebounded strongly in 2024:

- Premium cat food purchases are up 9% from 2023.

- Premium dog food purchases are up 5% from 2023.

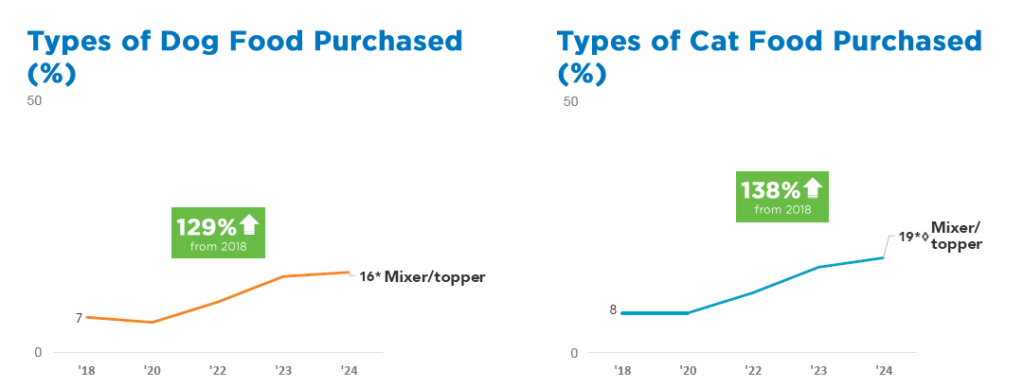

Functional toppers and mix-ins are growing even faster:

- 19% of cat owners and 16% of dog owners bought toppers/mix-ins in 2024—up 138% and 129% respectively from 2018.

Biologics (like probiotics) are also gaining traction as pet food ingredients:

- 13% of dog owners and 12% of cat owners buy probiotic mixes or probiotic-infused diets—up 18% and 9% respectively from 2023.

Trend 4: Proactive Healthcare Driven by Dietary Supplements

Health and wellness remain top of mind for #petowners—and the steady growth of the pet supplement category over the past six years proves it.

- Dog Supplements: 53% of dog owners give their pups vitamins or nutritional supplements—up 6% from 2023 and 56% from 2018.

- Cat Supplements: 34% of cat owners give their cats vitamins or supplements—also up 6% from 2023 and 70% from 2018.

Top supplement choices vary by pet:

- Dogs: Joint health/mobility supplements, skin/coat/nail products, and multivitamins are most popular.

- Cats: Multivitamins lead the pack, followed by probiotics or digestive supplements.

Trend 5: How to Apply These Insights

Looking ahead, one thing is clear: #Petparents want to integrate their pets into their lives as much as possible—and give them the best life possible. This means health and wellness are non-negotiable when they shop for:

- Pet food and treats

- Nutritional supplements

- Toppers and mix-ins

This year’s data paints a clear picture of shifting pet owner behaviors and priorities—especially around health, lifestyle integration, and adoption of premium products. Categories like cat harnesses, pet birthday gear, themed merch, and nutrient-rich food toppers are seeing double-digit (even triple-digit) growth. All of this signals that consumers are embracing a more holistic approach to #petcare.

For brands and retailers, the takeaway is simple: Meet pet parents where they are. Focus on products that support health, strengthen bonds, and fit seamlessly into their daily lives—and you’ll tap into the heart of today’s #petindustry growth.

Source: APPA