Even as the broader economy faces ups and downs, small-business owners aren’t letting uncertainty dim their outlook. They’re leaning into AI, seeking smarter funding options, and keeping a close watch on shifting market trends—including tariff changes—according to the latest Small Business Cash Flow Trend Report, a collaboration between lender OnDeck and cash-flow analytics firm Ocrolus.

The numbers tell a clear story: Confidence is high. A whopping 93% of surveyed small-business owners expect moderate to significant growth over the next 12 months—a sentiment that’s held steady for the past eight quarters. Retail-focused small businesses are just as resilient: Over 92% anticipate growth, even amid ongoing macroeconomic volatility.

“Small businesses are staying confident about growth opportunities next year, even as they work through challenges like inflation and cash flow,” says Jim Granat, Co-President of Small Business at Enova, OnDeck’s parent company. “They’re investing in AI, turning to fintechs for faster access to capital, and focusing on what they can control—their customers, cash flow, and creativity.”

Key Survey Findings That Matter for Small Businesses

Beyond the optimism, the report highlights several trends shaping how small businesses operate and plan ahead:

1. Working Capital: Fintechs Beat Traditional Banks

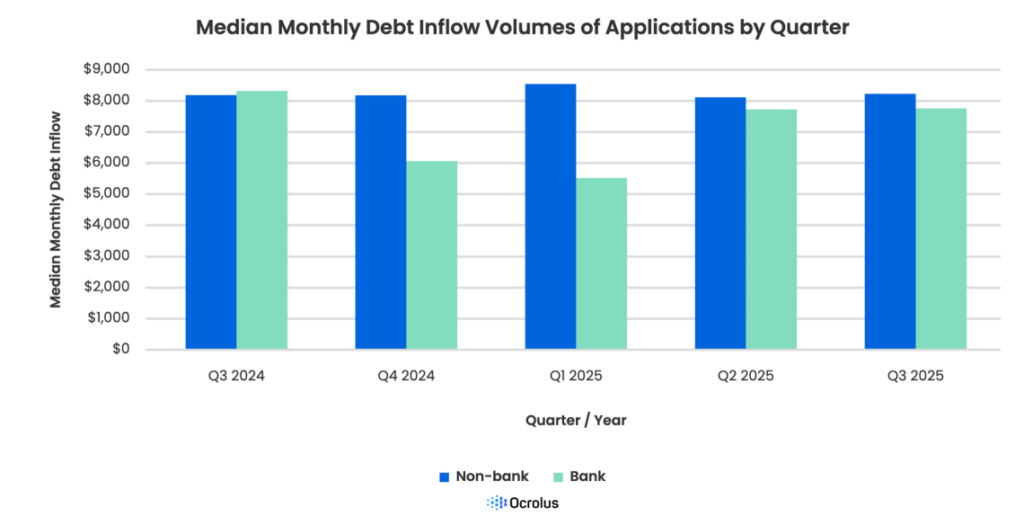

When it comes to securing funding, small businesses are bypassing traditional banks in favor of non-bank lenders and fintechs. Seventy-five percent (75%) now choose these alternative options—up slightly from 73% in Q2. It’s a shift driven by the need for faster, more flexible access to capital.

2. Top Challenges: Cash Flow and Inflation Persist

For 30% of small-business owners, cash flow and inflation remain the biggest worries. These ongoing pressures mean businesses are doubling down on strategies to manage expenses and keep money moving.

3. AI Adoption Is Going Mainstream

A majority (52%) of small-business owners have integrated AI into their operations. From streamlining customer service to optimizing inventory, AI is no longer just for big corporations—it’s becoming a practical tool for small teams too.

4. Tariffs Take a Backseat to Other Priorities

Most small-business owners (65%) aren’t sure how tariffs will impact their operations. For the rest of the year, they’re focusing more on factors like seasonal demand (40%) and access to credit (38%) than tariff fluctuations (18%) when shaping their business strategies.

“AI-powered data and analytics are changing how lenders understand small businesses,” adds David Snitkof, General Manager of SMB at Ocrolus. “By using advanced cash flow analytics to assess real-time financial health, lenders can make faster, more confident decisions—helping small businesses get the capital they need to grow and thrive.”

At its core, the report underscores that small businesses are adaptable, forward-thinking, and unshaken in their pursuit of growth. Even with challenges on the horizon, their focus on innovation, customer-centricity, and smart resource management is setting them up for success in 2026 and beyond.

Source: Pets+ Mag

One Response

### Summary

The article presents the results of the Q3 2025 OnDeck Small Business Cash Flow Trend Report, which analyzes survey responses from small business owners about their motivations, challenges, financial trends, and adoption of tools like AI. It also includes data on cash flow, loan applications, and industry-specific insights into revenue, expenses, and growth outlooks.

### Key Points

– The survey analyzed responses from 531 OnDeck customers conducted between September 10-21, 2025.

– Key motivations for starting a business include being one’s own boss (33.5%), greater income potential (26.2%), and following a passion (23%).

– 35.4% of businesses surveyed are women-owned, 22.4% minority-owned, and 19.6% family-owned.

– Among family-owned businesses, 87.5% are first-generation, and 56.3% intend to pass the business to family members.

– The top industries represented include Professional and Technical Services (29.9%), Healthcare and Social Assistance (16.4%), and Retail Trade (17.3%).

– A significant portion of businesses (27.9%) have been operating for 1-5 years, and 25.8% for 21+ years.

– Most businesses have 1-5 employees (48.4%), and 36.7% plan to increase headcount in the next six months.

– Annual revenue breakdown: 49% earn $100,000-$500,000, and only 0.4% earn more than $10M.

– 92.6% of businesses expect growth in the next year, with 30.5% predicting significant growth.

– Top concerns include inflation (30%), cash flow (30%), and revenue (18%).

– 70.2% of businesses have cash reserves to cover 1-2 months of expenses or less.

– Strategies to manage cash flow include using a business line of credit (56.7%) and delaying owner payments (52.9%).

– Main loan purposes include increasing cash flow (37.3%), covering expenses (32.8%), and business expansion (34.8%).

– 75% of respondents did not apply for traditional bank loans, citing hassle (42%) and perceived ineligibility (35.2%).

– Non-bank lenders are preferred for flexible terms (30.1%) and faster processes.

– 68.4% of businesses do not pass credit card processing fees to customers, and 40.1% do not accept alternative payment methods.

– 47.3% of respondents use AI tools like ChatGPT (88%) and Gemini (27.9%), mainly for marketing (65%) and productivity (33.2%).

– Seasonal demand (40.3%) and access to credit (38.2%) are key factors shaping business strategies.

– 60.1% of businesses noticed changes in customer behavior due to economic uncertainty, such as smaller purchase sizes (45.5%) and more cautious decision-making (41.1%).

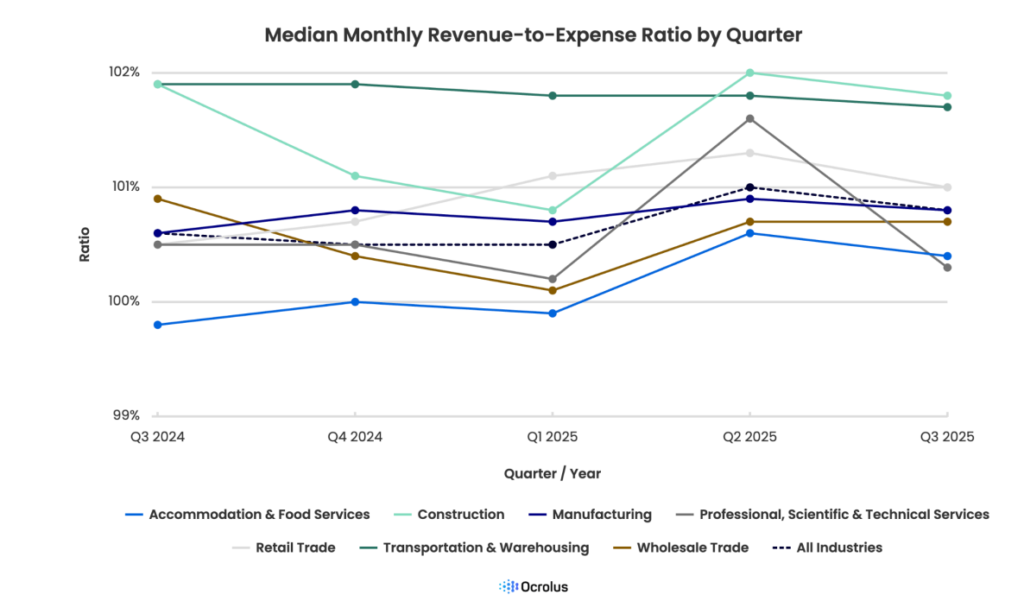

– Most sectors, including Retail and Construction, show consistent revenue-to-expense ratios, with moderate growth in Accommodation and Food Services.

– Fintech loan volumes remained steady year-over-year, while bank loan volumes declined by 5%.