Pet owners on both sides of the Atlantic are grappling with financial pressures tied to their furry companions. In the UK, skyrocketing #petinsurance premiums are the top concern, while in the US, surging veterinary care costs are pushing more owners to rely on insurance for protection.

The UK: Record-High Insurance Premiums

British #petowners are facing unprecedented hikes in their insurance costs. A recent report from CRIF— an European insurance and credit information provider—found that 36% of UK pet owners with insurance have seen sharp price increases over the past three years. Across Europe, 29% of policyholders reported similar jumps.

Nearly 4 in 10 (39%) UK pet insurance holders say their costs are now the highest they’ve ever been—more than double the European average of 15%. For many, this isn’t just a budgetary hassle: 39% of UK policyholders cite their pet getting sick or injured as a major financial worry.

CRIF points to several drivers behind the premium surge: rising vet fees, ongoing inflation, and a steep uptick in insurance claims. The Association of British Insurers (ABI) confirms the trend, with pet insurance claims hitting a record £1.2 billion ($1.6B/€1.4B) in 2024.

Despite the costs, pet insurance remains a priority for UK owners. Around 21% of UK consumers have pet insurance—higher than the 15% European average—and 17% say they’d cancel other insurance policies before dropping coverage for their pets. Notably, 32% of UK pet owners insure their pet’s life but not their own, far exceeding the 13% European average.

The US: Vet Costs Drive Insurance Adoption

In the US, soaring veterinary bills are pushing some pet owners into debt—fueling a growing turn to pet insurance. Data from the US Bureau of Labor Statistics shows that #petservices and vet costs rose 5.9% between January 2024 and January 2025.

A 2025 survey by MarketWatch Guides reveals that 83% of US pet owners think pet insurance is worth it, citing “peace of mind” and emergency coverage as top reasons. Only 16% dismiss it as not worth the cost.

The ASPCA (American Society for the Prevention of Cruelty to Animals) is the most popular provider, chosen by 20% of respondents. It’s followed by Healthy Paws (15%), Progressive (14%), and Lemonade (13%). When picking a provider, 65% prioritized coverage that fit their needs, 48% looked for low plan costs, and 40% were swayed by a positive reputation and online reviews. Overall, 74% of respondents reported being “satisfied” or “very satisfied” with their provider.

Pet Insurance Trends & Spending Habits

Across both markets, insurance trends and spending patterns highlight pet owners’ priorities:

- Insured pet ages: 42% are 2–5 years old, 23% are 6–8 years old, 18% are 0–2 years old, and 18% are seniors (9+ years old).

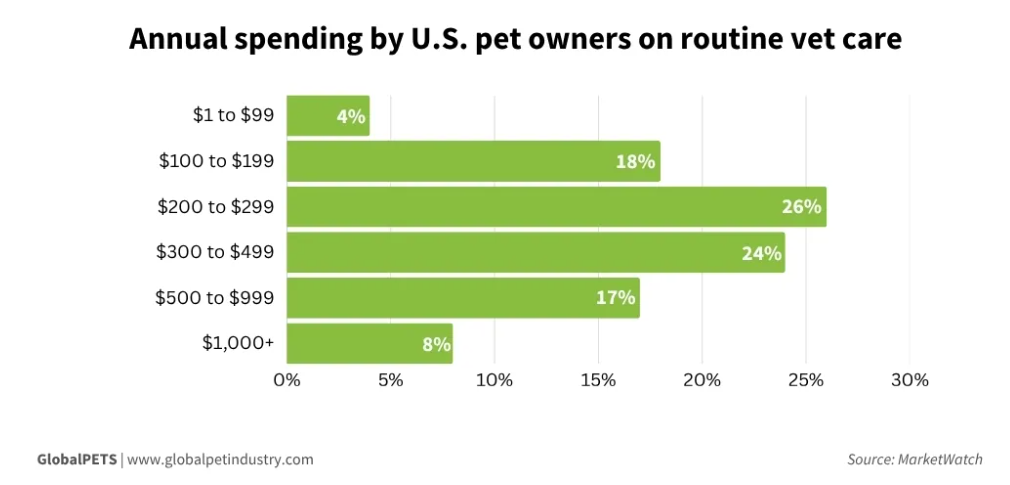

- Top spending category: 79% of owners spend the most on routine vet care (vaccinations, exams, bloodwork), while 17% focus on emergency care. A quarter (26%) of owners spend $200–$299 (€184–€275) on routine care annually.

- Savings for emergencies: 52% of respondents have dedicated savings for unexpected #petcare costs, with 67% of these savers being Gen Z or Millennials (18–35 years old).

- Premium ranges: 32% pay $21–$40 (€19–€37) per month (the most common bracket), 28% pay $41–$60 (€38–€55), and only 4% pay over $100 (€92+) monthly.

Common Insurance Claim Struggles

A third (33%) of survey respondents filed a pet insurance claim in the last year—57% submitted one claim, and 43% submitted two. While 82% had no issues during the process, others faced frustrations:

- Long reimbursement waiting periods (63%, the top complaint)

- Lengthy claims reviews (53%)

- Claim denials (48%)

The most common reasons for denial were pre-existing conditions (28%), claims filed during the policy waiting period (28%), lack of documentation (e.g., past medical records, 17%), hitting the plan’s annual limit (14%), and services not covered by the policy (14%).

Survey details: MarketWatch Guides polled 1,000 US pet owners via Pollfish on February 5, 2025. 74% were dog owners, and 25% were cat owners.

Source: GlobalPETS