Rising prices have become a persistent feature of the U.S. economy over the past year. Combined with evolving tariff policies, the cost of everyday goods—including household items, food, #petfood, and #petsupplies—has climbed steadily. American consumers are feeling the pressure more acutely, prompting widespread adjustments in spending habits.

Yet despite broad budget tightening, one category continues to show exceptional resilience: #petproducts.

1. Heightened Consumer Anxiety and Growing Pressure on Manufacturers

A recent survey by L.E.K. Consulting, covering 2,000 U.S. adults, reveals that most consumers view ongoing price increases as “difficult to absorb” and are actively switching to lower-priced alternatives or reducing purchases altogether.

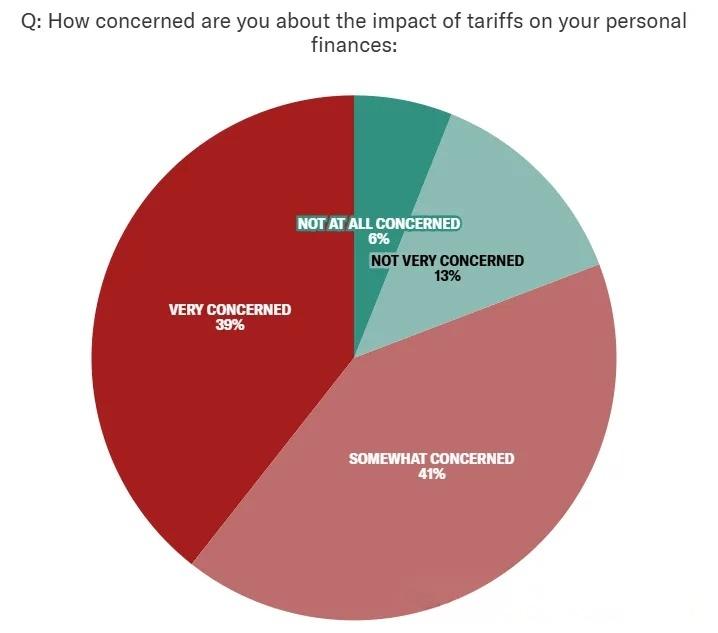

A Yahoo Finance/Marist poll further indicates that over 80% of Americans are worried that tariffs will weaken their purchasing power:

- 39% are “very concerned”

- 41% are “somewhat concerned”

- Only 19% are “not very concerned” or “not concerned at all”

This widespread “tariff anxiety” is reshaping how Americans shop and make purchase decisions.

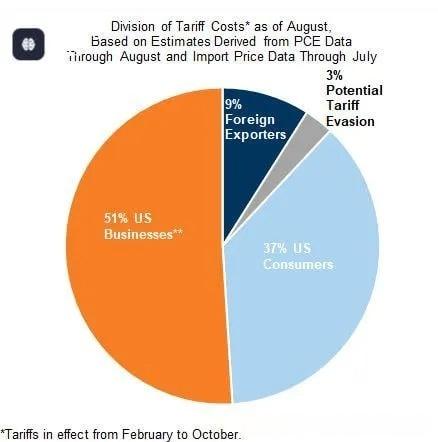

Goldman Sachs’ latest analysis shows that, as of August 2025, the burden of tariff-related costs is shared between companies and consumers:

- U.S. companies absorb 51% of tariff costs

- U.S. consumers bear 37% of the pressure

Economists expect this share to continue shifting toward consumers, with projections indicating they may shoulder 55% of tariff costs by the end of 2025.

At the same time, U.S. manufacturing activity continues to contract, with several manufacturers comparing the current environment to the downturn experienced during 2007–2009.

2. Accelerated “Trading Down” and a Heightened Focus on Value for Money

With living costs rising across the board, more Americans are revising their spending habits.

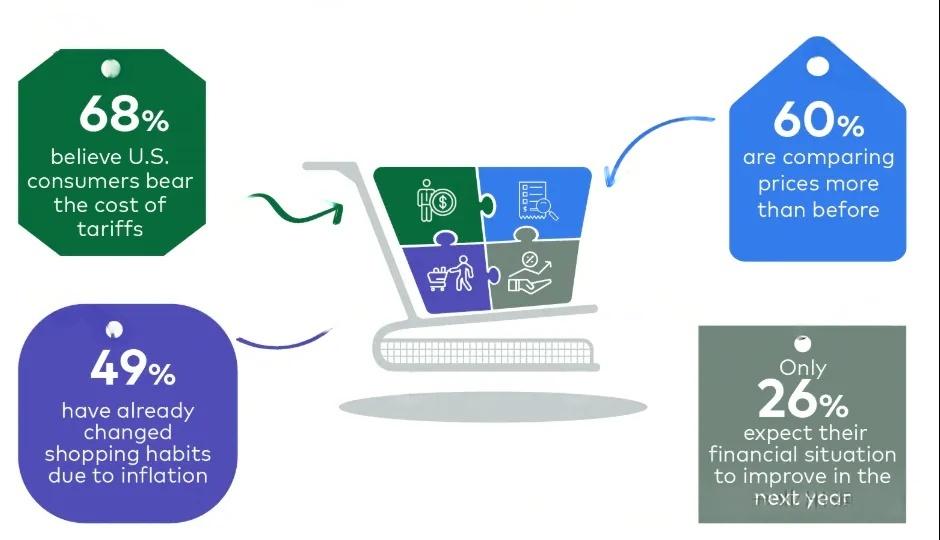

L.E.K.’s data shows:

- 68% of U.S. consumers believe tariff costs ultimately fall on them

- 49% have already changed how they shop

- 60% conduct price comparisons more often than before

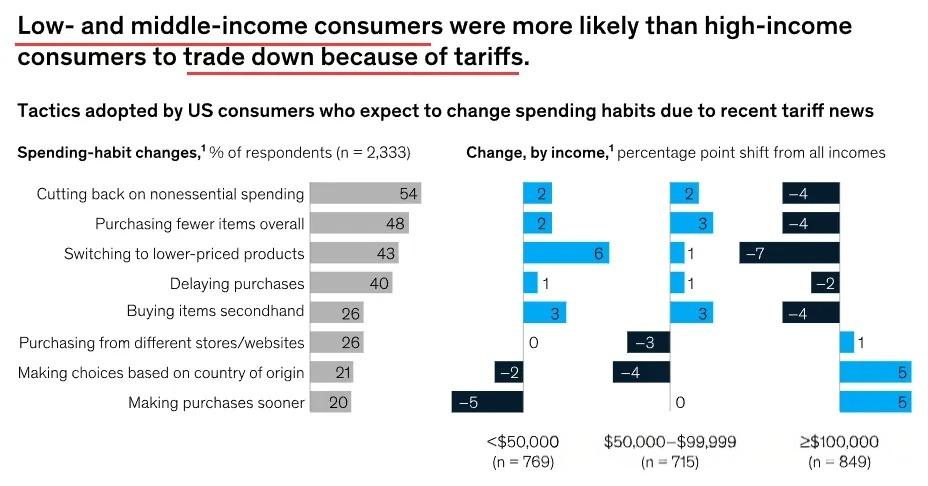

A May 2025 McKinsey study provides deeper insights:

- Lower-income households are far more likely to switch to cheaper brands

- Gen Z and Millennials display the largest behavioral shifts

- Baby Boomers, however, are less inclined to change their purchasing patterns

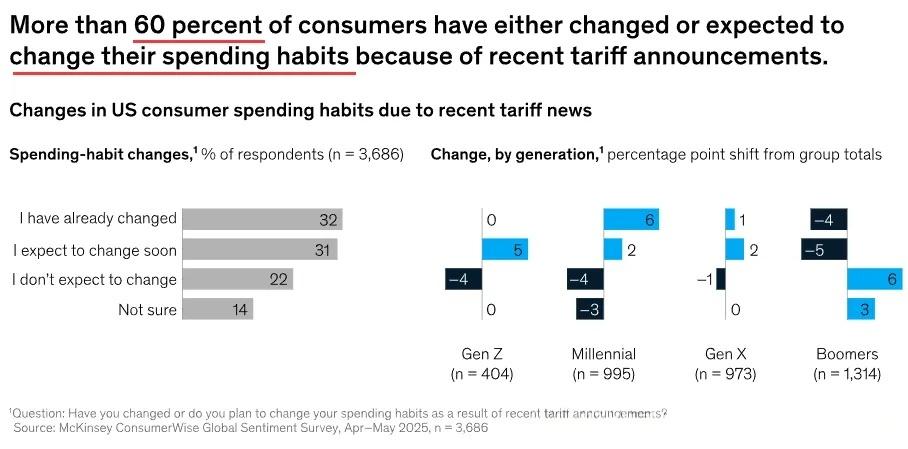

- Over 60% of consumers have changed or plan to change their spending because of tariffs

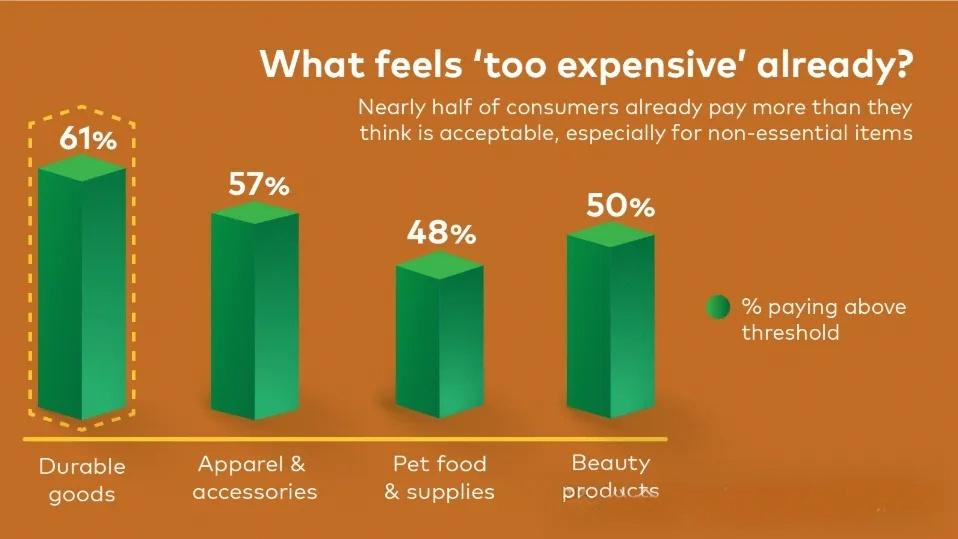

Although 48% of consumers believe pet food and pet supply prices are too high, they have not yet made significant cuts in this category.

3. Pet Supplies: A “Protected Budget Category” in U.S. Households

While many discretionary categories—such as apparel, accessories, and home goods—face substantial reductions, spending on pet supplies remains exceptionally stable.

According to L.E.K.:

- Only 27% of consumers plan to reduce spending on pet food or pet supplies

- By comparison:

- 74% plan to cut back on apparel and footwear

- 68% plan to reduce home goods purchases

This gap reflects a clear shift: pets have firmly transitioned from companions to family members, and their needs remain a top household priority.

Although the structural composition of the pet food market has yet to undergo major changes, analysts note that continued tariff and supply chain pressures could influence future pricing.

4. How Brands and Retailers Are Responding

Shifts in consumer expectations are prompting brands and retailers to revisit their value propositions and supply chain strategies.

Rob Haslehurst, Managing Director at L.E.K., highlights a key trend:

Leading brands are moving away from cost-plus pricing and toward value-based pricing grounded in what consumers actually care about.

To respond to rising costs and tighter customer budgets, companies are focusing on:

- Optimizing product design, materials, or assembly to minimize tariff impact (“tariff engineering”)

- Prioritizing product features that deliver tangible consumer value

- Simplifying designs or packaging to reduce production and logistics costs

- Building closer collaboration with suppliers to enhance flexibility and improve lead times

In a high-cost environment, supply chain efficiency, functional differentiation, and value clarity are becoming crucial drivers of competitive advantage.

5. Key Insights for Pet Companies (Brands, Retailers, E-Commerce, and Supply Chain Partners)

Based on the latest developments in the U.S. market and the unique spending patterns of pet-owning households, #petindustry stakeholders can draw several meaningful insights:

1. Strengthen Supply Chain Agility and Speed

Although consumers remain committed to pet products, they are increasingly price-conscious.

#Petbrands increasingly rely on suppliers who can offer:

- Rapid sampling and prototyping

- Fast replenishment and stable lead times

- Small-batch production capabilities

- Cost-optimized material or structural solutions

(These capabilities are exactly where Chinese OEM/ODM factories have strong advantages.)

2. Focus on Products With Clear, Perceivable Value

Even under budget pressure, U.S. pet families continue to prioritize:

- Comfort and safety

- Functional performance at reasonable cost

- Multi-scenario usability (outdoor, winter, indoor, rainwear)

- Visible product improvements (reflective accents, breathable fabrics, waterproof materials, durability, sustainability, etc.)

Products that communicate clear, practical value stand a higher chance of being prioritized in consumer spending.

3. Build Stronger Differentiation to Stand Out

As broader market growth stabilizes, product homogeneity becomes a major challenge. Brands can enhance differentiation through:

- Distinctive materials or performance features

- Upgraded functionality (warmth, waterproofing, lightweight design, breathability, etc.)

- Trend-driven aesthetics and colorways

- Exclusive or custom-developed SKUs in collaboration with suppliers

4. Maintain a Healthy Price Architecture While Protecting Margins

With tariffs rising and household budgets tightening, brands must:

- Leverage supply chain partners to ease cost pressure

- Simplify non-essential processes and materials

- Emphasize perceived value to avoid a race to the bottom

6. Final Thoughts

As inflation and tariff impacts continue to flow downstream, the U.S. #petmarket is undergoing a noticeable shift toward value consciousness, functionality, and transparent pricing.

In this evolving landscape, brands and supply chain partners that can:

- Understand U.S. consumers’ real expectations

- Offer agile, reliable, and cost-efficient supply solutions

- Co-develop products with strong functional value

- Balance affordability with performance and design

will be best positioned to capture growth and build long-term customer loyalty.

Pet spending will not disappear—

but the logic behind how consumers choose products is changing.

Adapting to these shifts will be essential for sustaining momentum in the next stage of industry development.