Subscription and loyalty models are increasingly reshaping how #petproducts and services are sold. What began as a convenience-driven digital solution has evolved into a powerful growth engine across retail, e-commerce, and pet healthcare—delivering recurring revenue, deeper customer relationships, and stronger omnichannel engagement.

In 2025, major #petretailers, insurers, and digital-first brands are demonstrating that subscriptions are no longer a niche tactic, but a core pillar of modern pet retail strategy.

Loyalty and Subscriptions Gain Momentum Across Retail and Healthcare

Retail and healthcare companies that invested in loyalty and subscription programs reported strong results in 2025, both in revenue growth and subscriber numbers. This momentum has been particularly visible in the pet sector, where subscription-based models continue to attract investment and consumer interest.

Beyond convenience, subscriptions offer predictability for businesses and perceived value for consumers—an increasingly important combination in an environment shaped by inflation and economic uncertainty.

Subscriptions Move Into Physical Stores in the UK

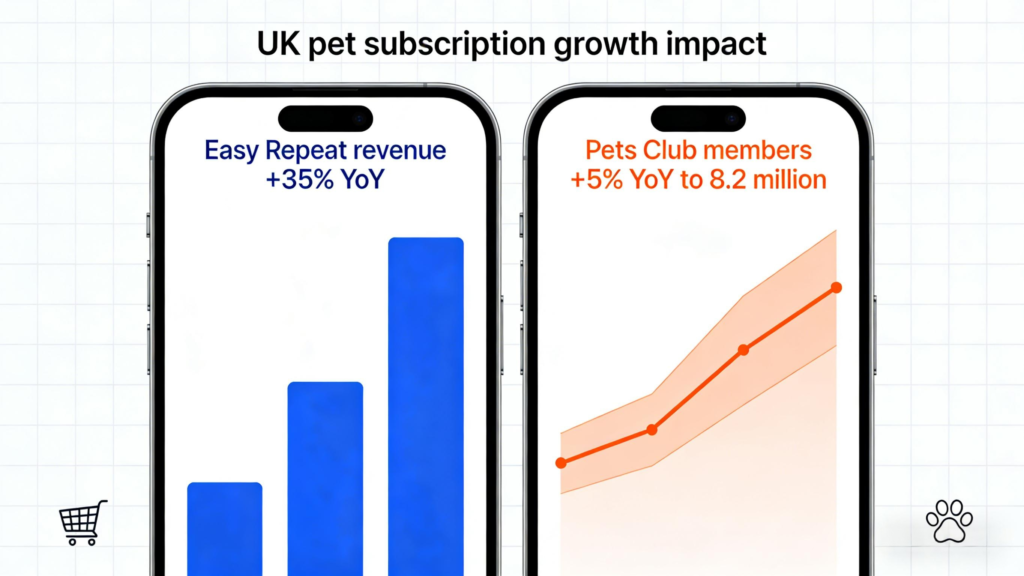

In April 2025, UK pet retailer Pets at Home expanded its Easy Repeat subscription service from online-only channels into physical stores. According to Sean Dorgan, Director of eCommerce & Digital, customer response has been “overwhelmingly positive,” driven largely by the absence of a minimum commitment and the flexibility to adjust delivery dates, frequency, and product selection.

As a result, revenue from Easy Repeat subscriptions—across both online and offline channels—grew by 35% year-on-year. The company’s loyalty program, Pets Club, also expanded by 5% YoY, reaching 8.2 million members.

Pets at Home continues to position physical stores as the foundation of its retail strategy, while using subscriptions to strengthen omnichannel engagement, increase footfall, and deepen long-term customer relationships.

Rapid Adoption in Brazil Highlights Store-Level Impact

A similar pattern has emerged in Brazil. In 2024, pet retailer Petz launched a loyalty and subscription platform and soon extended it to physical stores. According to the company, results were immediate.

Chief Financial Officer Aline Penna noted that the subscriber base doubled within one month, highlighting not only consumer interest but also the execution capabilities of in-store teams. The expansion reinforced the role of physical retail as a catalyst for subscription adoption rather than a competing channel.

Subscriptions Drive Performance in the US Market

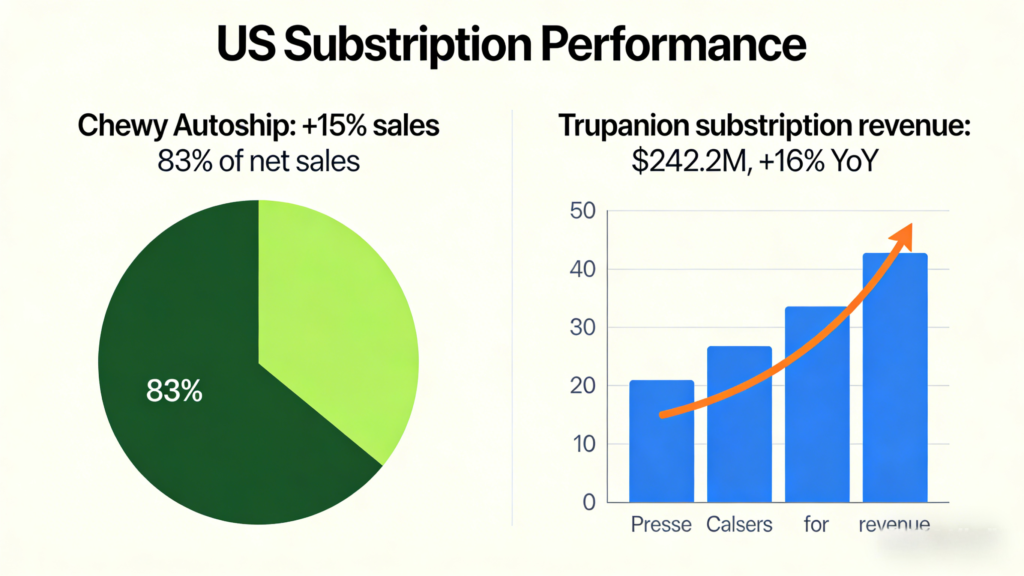

In the United States, subscriptions are proving effective across multiple #petindustry segments.

Online retailer Chewy attributed its strong Q2 2025 performance to its Autoship program. Net sales increased by 8.6% year-on-year, while Autoship sales grew by 15%, accounting for 83% of total net sales during the quarter.

#Petinsurance provider Trupanion also reported strong subscription-driven growth. In Q2 2025, subscription revenue rose by 16% YoY, reaching $242.2 million (€210.1M). The company surpassed one million pets enrolled, marking a 4% YoY increase.

Trupanion reported that veterinary claims grew from $3 billion (€2.6B) in 2024 to nearly $4 billion (€3.5B) in 2025, supported by pricing accuracy, customizable deductibles, unlimited coverage, and recommendations from veterinarians and third parties.

Discounts and Value Remain Central to Subscription Appeal

Rising prices and continued economic pressure are reinforcing demand for subscription-based value. While pet inflation has eased from its 2023 peak, household budgets remain under strain.

Pets at Home offers a 10% discount on subscription products collected in-store and a 5% discount on home-delivered items. According to Dorgan, this confirms sustained demand for value-driven solutions that combine savings with convenience.

Similarly, Petz structured its loyalty program with multiple tiers—ranging from free entry-level access to 30% discounts on services at the highest level. This approach aims to make pet care more accessible while encouraging long-term loyalty through savings, flexibility, and omnichannel integration.

When Subscription Brands Move Toward Retail

Interestingly, not all subscription growth follows the same direction. Some #petfood startups are expanding from online-only subscription models into physical retail.

In August 2025, UK-based fresh dog food brand Marleybones and cat food startup Untamed launched their products in supermarkets and pet retailers. Both companies cited growing demand for premium pet food, shelf-stable fresh formats, and broader omnichannel reach.

Despite this retail expansion, subscription remains central to their business models. Marleybones reports strong repeat purchase rates and continues to view subscriptions as the foundation of long-term growth.

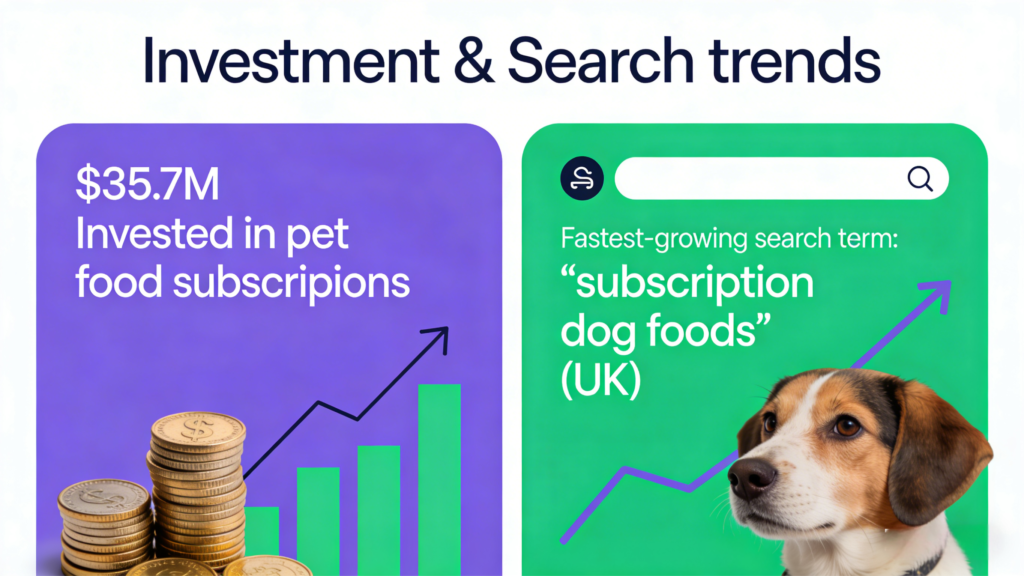

Search Trends and Investor Interest Signal Long-Term Potential

Consumer behavior data further supports the rise of subscriptions. A study by UK performance marketing agency Herd found that “subscription dog foods” was the fastest-growing pet-related Google search term in the UK between June 2024 and June 2025.

Investor interest mirrors this momentum. According to Tracxn, pet food subscription businesses were the second most funded pet category between July 2024 and July 2025, attracting $35.7 million (€30.9M) in investment—highlighting confidence in the scalability and resilience of the model.

Conclusion

Subscriptions are no longer just a convenience feature in pet retail—they are reshaping how brands engage customers, manage revenue, and build long-term loyalty. Whether integrated into physical stores, e-commerce platforms, or pet healthcare services, subscription models are proving adaptable across markets and business types.

As competition intensifies, success will depend on flexibility, value perception, and the ability to blend digital convenience with real-world engagement. For #petbusinesses across the supply chain, subscriptions represent not only a sales model, but a strategic lever for sustainable growth.

Source: GlobalPETS