Despite ongoing economic pressure and cautious consumer spending, the global #petindustry delivered a mixed yet revealing performance in the third quarter.

According to GlobalPETS’ analysis of 20 publicly reported earnings results, 12 companies achieved year-on-year (YoY) revenue growth, suggesting that while growth has slowed in parts of the market, demand has not disappeared—it has shifted.

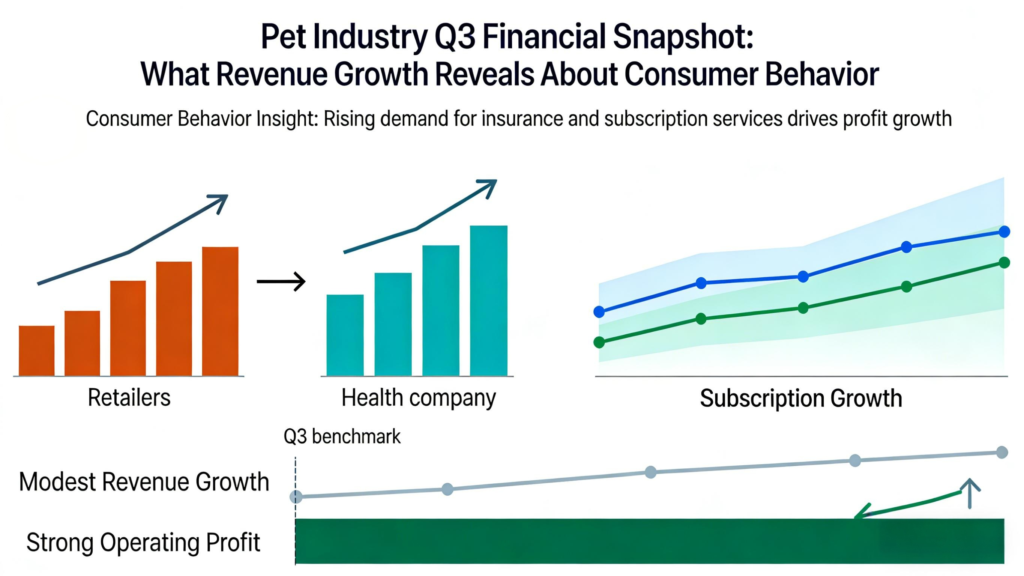

This financial snapshot highlights which business models are proving resilient, where pressure remains, and what these results reveal about evolving consumer priorities.

Retailers Lead Revenue Growth in a Challenging Environment

Among the strongest performers in Q3 were #petretailers, particularly those benefiting from store expansion and acquisitions.

GlobalPETS reports that at least six companies recorded double-digit YoY revenue growth, with retailers leading the list. These businesses shared two key characteristics: physical retail presence and scale-driven expansion strategies.

The performance underscores an important reality: even as discretionary spending tightens, #petowners continue to prioritize trusted retail channels—especially those offering convenience, availability, and in-store experiences.

However, growth did not come without challenges. Executives noted a visible deceleration in sales momentum during the year, largely influenced by shifting consumer sentiment and inflation-driven caution.

Pet Health and Insurance Continue to Attract Investment Attention

#Pethealth companies also emerged as notable winners during the quarter, aligning with broader structural trends in the industry.

Rising veterinary costs, ageing #petpopulations, and increased awareness of preventive care have continued to drive demand for health-related products and services. As noted by industry analysts cited by GlobalPETS, the #petinsurance segment remains particularly attractive due to its long-term growth potential.

One health-focused company reported:

- Over 1 million pets enrolled in its subscription model

- 5% YoY growth in enrolled pets

- A more than threefold increase in net income, supported by improved retention efforts

These results highlight how recurring-revenue models and predictable cost structures resonate strongly with pet owners during uncertain economic periods.

Manufacturers Show Mixed Results as Volumes Decline

While some pet health product manufacturers reported solid YoY growth—supported by strong performance in specific dog health categories—others faced headwinds.

GlobalPETS notes that volume pressure played a key role in underperformance for several companies, particularly those exposed to:

- Reduced consumer spending

- Distribution losses

- Product line rationalization

- Tariff-related inventory pressure

This divergence reinforces a key takeaway from the quarter: growth is increasingly selective, favoring businesses with differentiated offerings, strong channels, or high-margin product portfolios.

Profitability Tells a Different Story Than Revenue Alone

Revenue growth was not the only metric worth watching in Q3.

One major ingredient supplier reported only modest revenue growth, yet achieved a 79% increase in operating profit, driven by higher-margin product lines and portfolio optimization.

This result illustrates a critical industry shift:

margin management and product mix are becoming as important as top-line growth, particularly for manufacturers and suppliers operating in competitive categories.

What This Means for Pet Businesses

The Q3 financial snapshot points to several clear industry signals:

- Consumer spending has become more intentional, not absent

- Retail scale and physical presence remain powerful growth drivers

- Health, insurance, and subscription models offer resilience

- Margin-focused strategies are increasingly critical

For #petbusinesses across the value chain, the message is clear: growth is still achievable, but it requires sharper positioning, operational discipline, and a deeper understanding of how pet owners prioritize value in uncertain times.

Source: GlobalPETS