Manufacturing strategy in the #petindustry has become significantly more complex. While global demand for #petproducts continues to grow, manufacturers and brand owners are now making long-term decisions in an environment shaped by shifting trade policies, capacity limitations and rising expectations from #petowners.

Despite this volatility, meaningful opportunities still exist for companies that approach manufacturing with a long-term, data-driven mindset rather than short-term reactions.

Why Reshoring Alone Is Not a Simple Solution

The idea of “bringing manufacturing back” is often discussed as a universal solution, but in reality, it is highly category-specific within the pet industry.

Government incentives and industrial policies tend to favor sectors such as automotive, pharmaceuticals and semiconductors. Many #petcategories—particularly plush toys, soft goods and a wide range of accessories—do not fit neatly into these frameworks.

Even when landed costs for imports rise, domestic manufacturing capacity often falls short. In many cases, there is a lack of specialized facilities, tooling and skilled labor required to produce certain pet SKUs at scale.

As a result, most #petcompanies are not executing full reshoring strategies. Instead, they are taking more measured approaches, including:

- Shifting selected production volumes to alternative countries where capacity exists

- Maintaining partial production with existing overseas partners while absorbing higher costs

- Recognizing that onboarding a new country or building new facilities is a multi-year commitment, not a quick operational switch

For #petbusinesses, the takeaway is clear: manufacturing strategy must balance tariff exposure with real-world constraints such as labor availability, lead times and category-specific capabilities. In many cases, diversified multi-country sourcing is more realistic than an all-in reshoring approach.

Demand Tailwinds: Pet Ownership and Rising Product Complexity

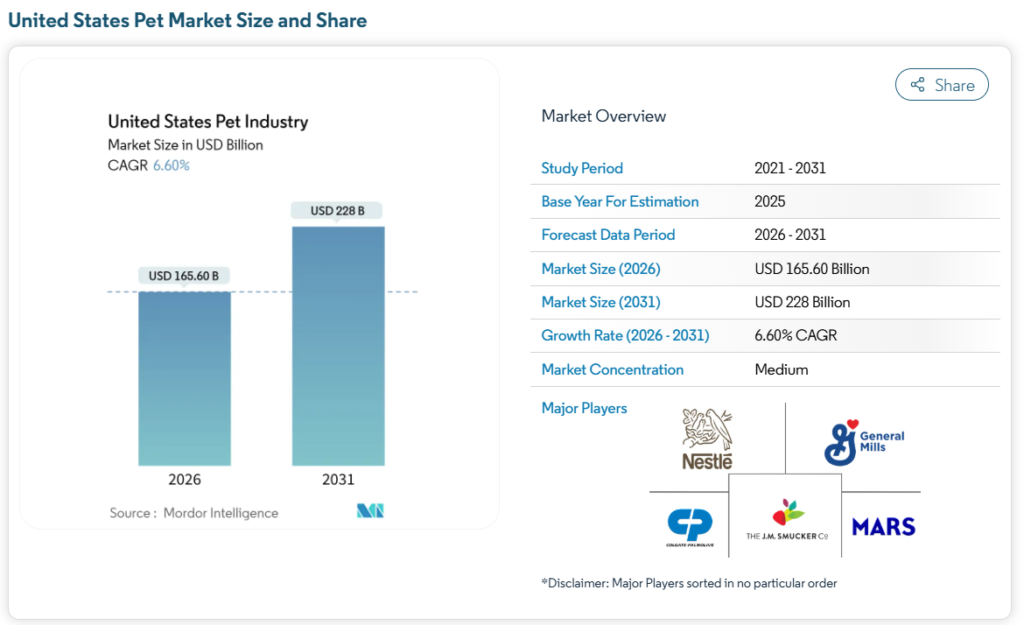

While manufacturing conditions remain challenging, underlying demand trends continue to support long-term growth.

According to the APPA 2025 State of the Industry Report, Gen Z and younger Millennial consumers are driving new pet ownership, even amid broader economic pressure. Many view pets as essential to emotional well-being and lifestyle quality, with Gen Z showing the highest likelihood of bringing home a new pet.

These shifts are reshaping manufacturing and supply-chain requirements in several ways:

- Larger formats and bundled offerings: Multi-pet households and new #petparents are driving demand for value packs, subscriptions and larger consumable sizes.

- Customization and niche SKUs: “Pet-as-family” dynamics support specialized products such as enrichment toys by play style, modular beds and lifestyle-driven solutions.

- Higher SKU complexity: Serving these expectations requires managing more SKUs, smaller batch runs and more granular demand forecasting by generation, household type and channel.

In parallel, emerging trends such as pet-friendly workplaces are opening new commercial opportunities, including office-ready pet products, B2B bundles and corporate wellness initiatives that include pets.

Manufacturing decisions, therefore, are no longer driven by cost alone. They must support faster innovation cycles, higher differentiation and omnichannel distribution across retail, e-commerce and B2B environments.

Policy Incentives: Expensing Rules as a Strategic Lever

While trade policy has added uncertainty, tax policy is simultaneously creating incentives for domestic investment.

According to TaxFoundation.org, the One Big Beautiful Bill Act (OBBBA) introduces more favorable expensing rules for manufacturers, including:

- Full and immediate expensing for eligible manufacturing facilities, replacing traditional long-term depreciation schedules

- Restored 100% bonus depreciation for qualifying machinery and production equipment

For pet companies with the capital and operational readiness to invest closer to end markets, these incentives can lower effective investment costs, improve near-term cash flow and make automation or quality upgrades more financially viable.

However, these benefits are time-sensitive and complex. Companies must carefully evaluate construction timelines, facility qualifications and alignment with broader tax, financing and capital strategies.

This is a moment that requires coordination across finance, operations and supply-chain leadership to determine whether near-market capacity expansion makes strategic sense.

A Practical Manufacturing Playbook for Pet Companies

In today’s environment, the most resilient pet businesses are not chasing a single “perfect” solution. Instead, they are focusing on flexibility and optionality.

Key approaches include:

- Scenario-based sourcing strategies

Modeling multiple country and partner combinations rather than committing to a single location. - Aligning capacity with evolving demand

Designing manufacturing capabilities around Gen Z behavior, multi-pet households and emerging B2B channels—not just historical volume. - Using incentives as accelerators, not drivers

Treating tax and policy benefits as tools that support sound strategy, not as reasons to force manufacturing decisions. - Building flexibility into contracts and product design

Shorter commitments, modular product structures and adaptable materials help companies respond as conditions change.

Manufacturing in the pet industry today is not about finding one definitive answer. It is about building a resilient system—one that can adapt to shifting trade rules, leverage policy incentives and still deliver the quality, innovation and value modern pet families expect.

Source: APPA