Brand perception, trust and purchase intent are shifting worldwide

Recent global research suggests that international consumers are increasingly cautious about brands perceived as “American.” What was once associated with quality and aspiration is now, in many markets, viewed with greater skepticism — a shift that has direct implications for consumer-facing industries, including #petcare.

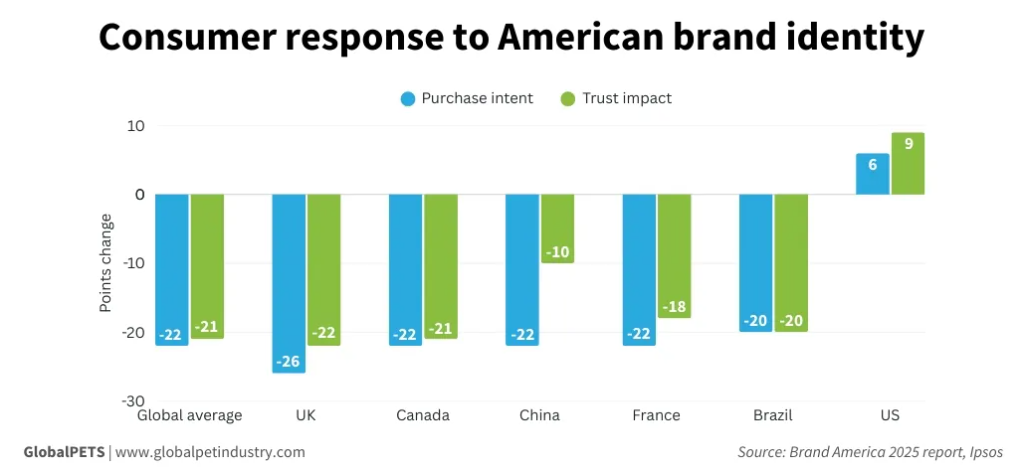

According to the Brand America 2025 report by Ipsos, brands recognized as American face a measurable decline in trust and purchase intent across non-US markets. On average, trust drops by 22 points, while willingness to purchase falls by 21 points when consumers identify a brand as American.

Notably, this trend appears consistently across all surveyed countries except the United States itself.

Where the resistance is strongest

The Ipsos study surveyed 9,012 respondents across 10 countries, including China, Brazil, the UK, France, Germany, Canada, Japan, Mexico, India and the US.

Among them, the United Kingdom and Canada showed the strongest negative reaction toward American-branded products. Earlier research cited by GlobalPETS found that 42% of Canadian consumers say they would “absolutely do everything” to avoid buying products from US companies.

These findings suggest that brand origin perception is no longer a neutral factor in international markets — it can actively shape consumer behavior.

“American” versus “international” brand perception

Interestingly, Ipsos found that consumer attitudes shift significantly when brands are perceived as “international” rather than explicitly American.

Across all 10 countries surveyed, brands viewed as international are more likely to be trusted and purchased. The exception is the US market itself, where domestic brands benefit from a 6-point increase in purchase intent and a 9-point increase in trust when associated with American origin.

This contrast highlights a growing divergence between domestic and international brand positioning strategies.

Does this apply to #petbrands?

The #petindustry follows different emotional and behavioral rules compared to categories such as fashion or electronics.

Kristy Click, Senior Vice President and Senior Client Officer at Ipsos US, notes that #petfood and pet care purchases are driven primarily by trust, safety and health considerations — not geopolitics. Switching pet food is often avoided due to fears of digestive issues or health risks, which creates unusually high brand loyalty.

In many cases, #petowners are more loyal to their pet’s food brand than to brands they buy for themselves. This loyalty acts as a buffer against broader national-origin bias.

Regulation, availability and local influence still matter

Beyond perception, practical factors play a decisive role. In the European Union, strict pet food regulations shape which brands are available and how they are positioned. Supply chain constraints, import rules and strong local competitors can limit exposure to foreign brands altogether.

Veterinarian recommendations and regulatory compliance often outweigh brand nationality, particularly in food and health-related pet categories.

American pet brands still perform strongly — with nuance

Despite growing skepticism toward “American” branding in general, many US-origin pet food brands remain highly preferred internationally.

Brands such as Purina (Nestlé), Whiskas (Mars), Hill’s Pet Nutrition (Colgate-Palmolive) and Blue Buffalo (General Mills) rank among the top preferred dog and cat food brands in markets including Brazil, Canada, France, Mexico, the UK and the US.

However, ownership structures complicate perception. Many brands originated locally before being acquired by multinational groups, making national identity less clear to consumers — and sometimes less relevant.

What this means for pet brands

For #petbusinesses operating internationally, the findings underline an important strategic consideration: how a brand is perceived can matter as much as what it sells.

Ipsos suggests that companies should carefully calibrate their messaging. Emphasizing contributions to local communities, compliance with regional standards and collaboration with local partners can help offset negative origin bias — without abandoning core brand identity.

The goal is balance, not disguise.

What this means for pet brands working with OEM partners

For brands that rely on OEM manufacturing, brand perception and supply chain strategy are increasingly connected.

- Manufacturing location, certifications and compliance standards can support a more “global” brand narrative.

- Transparent supply chains help reinforce trust, particularly in food, supplements and functional #petproducts.

- OEM partners capable of meeting regional regulatory and labeling requirements enable smoother market entry and localization.

In a climate where origin perception influences trust, OEM partnerships are no longer just about cost efficiency — they are part of brand credibility.

Source: GlobalPETS