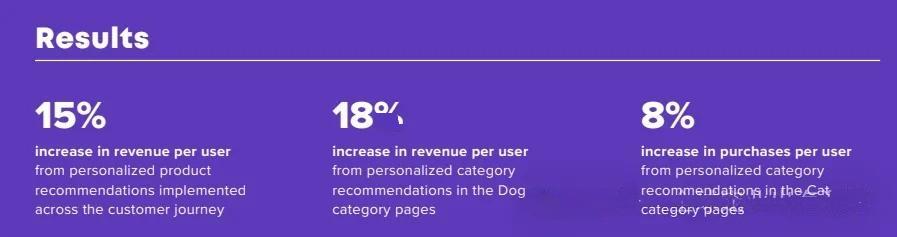

Recently, Pets Place, the largest #petcare retailer in the Netherlands, delivered an impressive performance report. Driven by online sales, its turnover reached approximately €300 million in 2024, a year-on-year increase of 15%. More notably, online sales accounted for 25% of the total turnover.

Among this, thanks to personalized category recommendations, revenue per user on the “dog category” page rose by 18%, while the “cat category” saw an 8% increase.

Category Performance

Non-food products are growing, partly due to more shelf space allocated to these items. Dog and cat products showed particularly strong growth in large stores, and sales of frozen #petfood also surged year-on-year.

Meanwhile, the retailer announced plans to open 10 new large-scale stores in 2025 and upgrade existing store spaces and service functions—such as adding veterinarians, grooming salons, and dog washing facilities.

Pets Place continues to invest in physical store operations. In 2024, it opened new stores in Utrecht, Lelystad, and Drachten. Additionally, the company acquired a 5,000-square-meter store in The Hague.

Creating a High-Quality Shopping Experience for Pet Owners

Pets Place is part of IJsvogel Retail, a company with over 50 years of experience in the pet and gardening products market. It offers a wide range of #petsupplies, food, and accessories to meet the needs of various pet types and owners.

Currently, Pets Place operates 175 stores in the Netherlands, opening around 12 new stores each year. Its plan is to close smaller stores and open larger ones, targeting 230 stores to expand its coverage in the region.

Online, it runs two e-commerce websites, serving the Netherlands and Belgium. It is understood that Ard Malenstein, General Manager of Pets Place, comes from a family engaged in wholesale and retail and has worked in the #petindustry for over 25 years.

Pets Place’s success stems from several key factors:

1. Personalized Recommendations (Data-Driven Decisions)

To enhance the consumer shopping experience, Pets Place uses personalized technology to provide customized product recommendations and content. For example, every banner, notification, and product recommendation on its homepage is tailored to the needs of consumers and their pets—whether for cats, kittens, dogs, or rabbits. Pets Place offers multiple variations for each element and market segment.

2. Customer Loyalty (Commitment to Pet Wellbeing)

Pets Place aims to build strong personal relationships with customers to foster loyalty and repeat business. Currently, the retailer offers over 15,000 products across numerous categories from more than 200 brands.

In addition, Pets Place sends personalized messages to each customer group, aiming to provide #petowners with the tools and information needed to make the best choices for their pets.

3. Omnichannel Strategy (Offline + Online)

Pets Place focuses on both in-store and online shopping experiences, aiming to deliver a seamless and personalized customer journey. Behind this strategy lies a new logic in the global #peteconomy—”omnichannel” is no longer an option but a survival rule.

Omnichannel Integration and the Future Retail Landscape

In the Dutch #petretail market, Pets Place is setting a model for traditional retailers’ digital transformation through a dual-driver strategy of “deepening offline operations + breaking through online sales.”

Under Ard Malenstein’s leadership, Pets Place’s expansion path reflects profound changes in the pet retail industry. As mentioned earlier, the new stores in Utrecht, Lelystad, and Drachten are all strategically located in areas with high population density and strong #petownership rates. The retailer’s emphasis on the “large store + veterinary services + grooming salon + dog washing” combination essentially builds an ecological closed loop for pet owners’ lifestyles.

This “super store” model involves three major value restructurings:

- Increasing average transaction value through service integration—high-margin businesses like #petgrooming and medical care can offset declining retail profit margins.

- Enhancing user stickiness—service scenarios have high-frequency consumption attributes.

- Creating brand landmarks—the experiential value of physical stores has become increasingly prominent in the digital age.

In an interview with the media, Ard Malenstein stated that large stores often have higher consumption levels due to more choices. Additionally, customers frequently purchase larger items, leading to higher online spending as well.

Next, Pets Place plans to expand into Germany, targeting major cities like Berlin and Hamburg with prime locations. Before that, it will first launch its full product range online and assess customer preferences. The focus is to understand the market and find suitable expansion locations.

Final Thoughts

The ultimate battlefield of the pet economy lies in breaking channel boundaries. The expansion strategy represented by Pets Place reveals the industry’s core formula: offline spaces create the “third space for pet lifestyles,” online platforms build a content ecosystem for pets, and omnichannel data drives precise services.

This indicates that the real transformation of pet retail has only just begun.

One Response

Pets Place’s Business Performance and Strategy

Pets Place, the largest hashtag#petcare retailer in the Netherlands (under IJsvogel Retail with over 50 years of history), achieved remarkable results in 2024: its turnover reached around €300 million with a 15% year-on-year growth, and online sales accounted for 25% of total turnover. Personalized recommendations drove revenue growth—18% per user in the dog category and 8% in the cat category. Non-food products grew due to increased shelf space, while dog/cat products (especially in large stores) and frozen hashtag#petfood saw significant sales surges.

Expansion & Store Operations

– Current scale: 175 stores in the Netherlands, opening ~12 new stores yearly; 2 online websites covering the Netherlands and Belgium.

– Future plans: Close smaller stores to open larger ones (targeting 230 stores total), with 10 new large stores and existing store upgrades (adding veterinarians, grooming salons, dog washing facilities) in 2025. It also acquired a 5,000-square-meter store in The Hague in 2024 and plans to expand into Germany (starting with online product launches to assess customer preferences, focusing on cities like Berlin and Hamburg).

Key Success Drivers

1. Data-driven personalized recommendations: Tailored homepage banners, notifications, and product suggestions based on consumers’ and their pets’ needs.

2. Customer loyalty via pet wellbeing focus: Offers over 15,000 products from 200+ brands and sends personalized messages to help hashtag#petowners make informed choices.

3. Omnichannel strategy: Integrates in-store and online experiences to provide a seamless shopping journey, a “survival rule” in the global hashtag#peteconomy.

“Super Store” Model Value

Large stores boost consumption (more choices, higher online spending from big-item purchases) and create value via:

① offsetting retail margin declines with high-margin services (grooming, medical care);

② enhancing user stickiness through high-frequency services;

③ building brand landmarks with experiential physical spaces.

Overall, Pets Place’s strategy reflects the pet retail industry’s shift—breaking channel boundaries by combining offline “pet lifestyle third spaces” and online content ecosystems, with omnichannel data enabling precise services—signaling the start of real transformation in hashtag#petretail.