As Europe’s #petindustry continues to mature, attention is gradually shifting beyond dogs and cats toward smaller companion animals. Birds and hamsters, often perceived as low-maintenance pets, are emerging as meaningful growth segments shaped by changing consumer expectations, higher welfare awareness, and a move toward quality-driven purchasing.

While overall ownership numbers remain smaller compared with mainstream pets, the past five years reveal a clear structural evolution in how these categories are developing—and where future opportunities may lie for brands, retailers, and supply chain partners.

A Structural Shift Toward Higher-Quality Ownership

During the pandemic, demand for birds and hamsters increased significantly, driven largely by families and first-time #petowners. Although the market has since normalized, industry experts agree it has stabilized at a noticeably higher quality baseline.

According to Wagner Pet Products Group, consumers today are far more conscious of animal welfare and product longevity. Housing solutions designed with adequate space, durable materials, stainless steel feeding systems, and natural wood components continue to perform steadily, reflecting a long-term shift away from entry-level products.

At the same time, reduced cage assortments in brick-and-mortar #petstores have created challenges. With more customers pushed toward online purchases, access to professional advice has diminished—particularly problematic for small animals whose welfare depends heavily on proper housing and setup.

Quality Over Quantity Becomes the Dominant Trend

Not all industry leaders interpret declining ownership numbers negatively. Versele-Laga, a Belgian specialist in pet nutrition and care, observes that while both bird and small mammal categories have contracted in volume, quality-led demand is becoming increasingly concentrated.

The market is moving toward premium species, better living conditions, and more sophisticated care solutions. According to Versele-Laga, the slowdown is driven less by consumer disinterest and more by hesitation among retailers—many of whom focus narrowly on the costs of keeping live animals rather than the broader benefits of increased foot traffic, engagement, and overall basket value.

In a period of economic uncertainty, industry voices emphasize that reducing assortment depth may ultimately weaken category value. Enhancing animal welfare, design, and customer experience adds long-term value not only to pets, but also to the businesses serving them.

Hamsters: A Resilient and Regionally Driven Segment

Although Europe lacks fully aggregated data on hamster populations, national statistics provide valuable insight. According to Statista, hamster ownership in the UK increased from 1.5% to 2.1% of households between 2022 and 2024, representing approximately 600,000 animals. In Italy, hamsters account for around 3.4% of household pet ownership.

Industry experts note that hamster populations peaked during the pandemic and have since stabilized at levels slightly above those seen in 2019. Growth has been especially pronounced in Central and Eastern Europe, where housing constraints and family demographics favor smaller pets.

While cyclical in nature, the hamster segment is showing signs of becoming structurally stronger, supported by increasing willingness among owners to invest in appropriate housing, enrichment, and nutrition.

Bird Ownership Remains Stable Across Europe

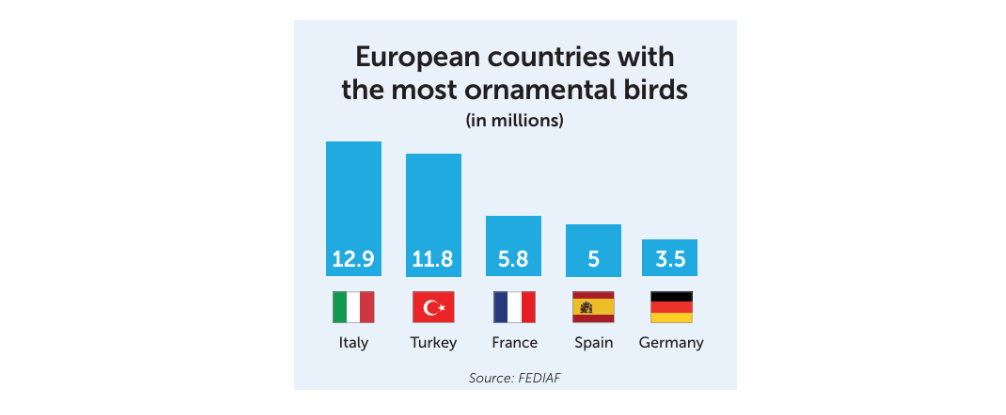

Compared with small mammals, bird ownership has remained relatively stable. Data from the European Pet Food Industry Federation (FEDIAF) estimates approximately 48.2 million ornamental birds across Europe, with Italy leading at 12.9 million.

Moderate growth has been observed in Southern European markets such as Spain, Portugal, and Italy, alongside renewed interest in countries including Poland and Romania. In contrast, the DACH region remains mature, with demand focused less on new ownership and more on long-term keeping, enrichment, and premium housing solutions.

Who Owns Small Pets Today?

Ownership demographics for birds and hamsters differ significantly from those of dogs and cats. Hamsters remain popular among families with children, often viewed as “starter pets” that introduce responsibility and routine.

However, manufacturers such as Burgess Pet Care report a growing number of adult hamster owners. These consumers typically have a stronger understanding of welfare needs and are more inclined to invest in suitable environments, enrichment, and nutrition—an evolution partly influenced by post-pandemic lifestyle adjustments.

Bird ownership spans an even broader demographic spectrum, ranging from younger hobbyists keeping budgerigars to experienced parrot owners with deep emotional attachment and high spending willingness.

Challenges That Also Create Opportunity

Despite encouraging signals, the market faces structural challenges. Overall category size is under pressure, retail space for larger enclosures continues to shrink, and online-only sales cannot fully replace expert consultation.

At the same time, expectations around product quality, functionality, and education are rising. Opportunities lie in targeted innovation—such as functional treats, smarter packaging, improved enrichment solutions, and housing designs that genuinely meet species-specific needs.

A persistent challenge in the hamster category is low perceived value due to the animal’s low purchase price. Industry experts agree that improving the ownership experience—by supporting natural behaviors and promoting longer, healthier lives—can increase repeat purchases and strengthen category sustainability.

Market Outlook

According to Market Report Analytics, the global hamster products market is valued at approximately $500 million (€435.6M) in 2025, with a projected CAGR of 5% through 2033.

Meanwhile, Market Data Forecast estimates the overall European #petmarket will grow from $6.74 billion (€5.87B) in 2025 to $12.7 billion (€11.1B) by 2033, at a CAGR of 8.24%.

Growth in the European bird food segment is more moderate. Cognitive Market Research reports a market size of $705.4 million (€614.5M) in 2024, with an expected CAGR of 2.5% through 2033.

Conclusion

Birds and hamsters may be small in size, but they represent meaningful opportunities within Europe’s evolving pet market. As the industry shifts toward education, welfare, and thoughtful design, success will depend less on scale and more on value creation.

For #petbusinesses across the supply chain, the future lies in delivering better ownership experiences—where quality products, informed consumers, and responsible care come together to support long-term growth.

Source: GlobalPETS