Walk the streets of Santiago today, and you’ll notice a clear trend: #petshops are popping up everywhere. In just five years, their numbers in Chile’s capital have more than doubled—and that’s a sign of a pet market that’s exploding with potential. Young families, shifting spending habits, and a growing love for furry companions are driving the surge, but what does this growth really mean for brands and retailers? Let’s break it down.

The Numbers Tell the Story: A Surge Across Cities

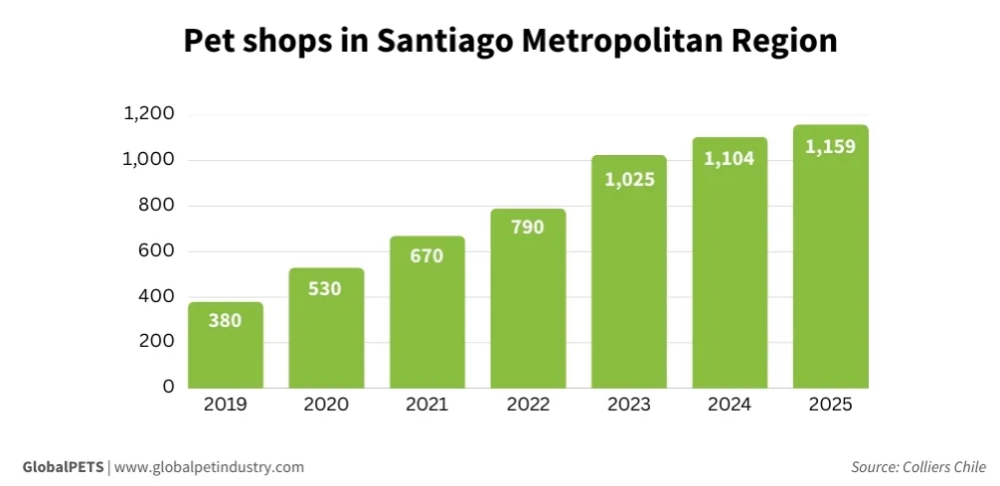

Real estate consultancy Colliers has tracked a striking shift: over just five years, the number of pet shops in Chile’s capital has more than doubled—jumping from 530 in 2020 to 1,159 in 2025. These stores aren’t randomly scattered, either. “They’re booming in high-density areas where young families—especially millennials—live,” says José Ignacio Arteaga, Business Intelligence Manager at Colliers Chile.

Beyond the capital, the growth story extends across Chile. Data intelligence firm Xbrein reports that nationwide, pet shops and related services have grown 35% in four years—from 2,500 establishments to nearly 3,400. What’s notable is that this boom isn’t limited to wealthy neighborhoods; it’s crossing socioeconomic lines, proving pets have become a priority for Chileans from all walks of life.

Why the Explosion? Pet Humanization and Shifting Priorities

This growth didn’t happen by accident. It’s rooted in three key trends reshaping Chilean society—and the #petindustry along with it.

First, there are more pets than ever. The Chilean government’s 2022 study (its first ever on pet populations) counted over 12.4 million dogs and cats. Analysts say that number has only grown, tied closely to the country’s declining birth rate — which hit a historic low in 2023. “In certain age groups, resources that were once earmarked for children’s products and services are now being redirected to pets,” explains Daniel Encina, CEO and founder of Xbrein.

Second, “pet humanization” is driving spending beyond just food. Young families aren’t just feeding their pets—they’re dressing them, accessorizing them, and investing in their health. “Spending now covers clothing, accessories, and medicine, not just kibble,” Arteaga notes. This aligns with global trends, where pets are increasingly seen as family members rather than just animals.

Third, Chileans have the means to splurge. With one of the highest GDP per capita rates in South America, the country’s #petowners spend more than $80 annually per pet—far more than in Brazil or Mexico, says Juan Pablo Martínez, CEO of distributor Ludipek. That purchasing power is fueling demand for better products and more stores.

Big Brands Are Taking Notice—Including Nestlé Purina

The market’s potential hasn’t escaped global players. In July, Nestlé Purina announced a $30.1 million investment to expand its distribution center in Chile’s Teno province. The goal? Boost its logistics capacity by 60% and turn Chile into Purina’s largest Latin American distribution hub. It’s a clear vote of confidence: Purina projects Chile’s #petfood industry will grow 37% over the next five years.

What’s Next? Maturation, Regional Gaps, and Challenges

Don’t expect the 25% annual compound growth rate of the past four years to last forever, though. “Demand will stay high, but growth will moderate,” Arteaga predicts. The market is entering a “maturation phase,” where brands will be tested on their ability to stand out amid more competition and savvier consumers.

There are also untapped opportunities. Right now, most pet shops are concentrated in metropolitan areas—but Xbrein sees room to grow in smaller regions. For brands willing to expand beyond Santiago, that’s a chance to get ahead of the curve.

But challenges loom. 2026 could bring headwinds like rising unemployment and slow economic growth, which might make pet owners more cautious with their spending.

How the Industry Is Adapting

Distributors and retailers are already adjusting to keep up. For Ludipek, the surge in stores means rethinking how products reach shelves. “We’ve had to build more capillary, segmented distribution,” Martínez says. The company has expanded its logistics network, used technology to professionalize inventory management, and deepened partnerships with retailers.

Other shifts are taking hold too:

- Omnichannel strategies: With Chilean consumers highly connected, brands are blending online and in-store experiences.

- One-stop shops: Many stores now offer integrated services like grooming, veterinary clinics, and #pethospitality.

- Exclusive brands: Private-label lines are becoming more common, helping retailers stand out.

The Takeaway: A Market in Transition

Chile’s pet shop boom isn’t a fad—it’s a reflection of how pets have woven themselves into the fabric of family life. The next few years will bring slower growth, but also more opportunities for brands that understand local needs: think affordable luxury, region-specific distribution, and products that treat pets like family.

For global players and local businesses alike, Chile’s #petmarket is no longer one to watch—it’s one to act on.

Source: GlobalPETS