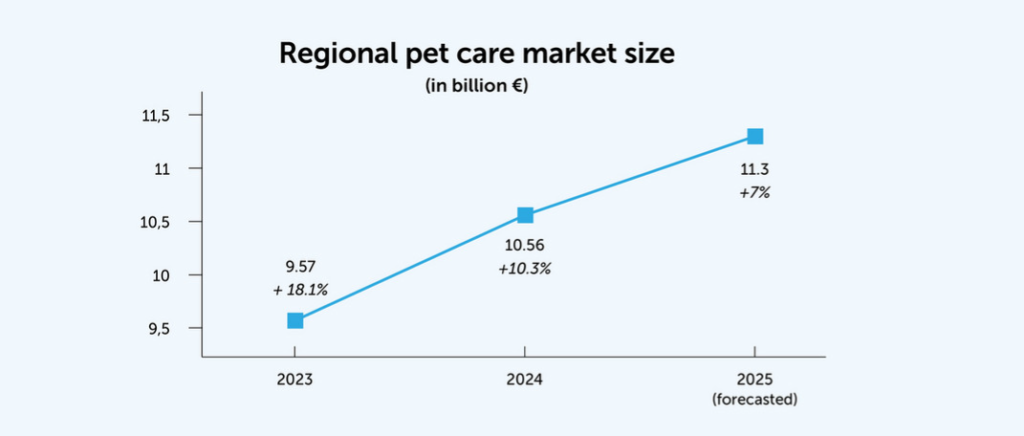

If you’re keeping tabs on Europe’s #petcare industry, don’t overlook Central and Eastern Europe (CEE). Poland, Hungary, the Czech Republic, and Slovakia might not grab the same headlines as Western Europe, but their #petmarkets are growing steadily—and they share more similarities than differences. From rising #petownership to booming e-commerce, let’s break down what’s happening in each country and how it stacks up against the West.

Back in 1989, when many countries in this region regained independence and started aligning with Western Europe, a new era began for industries across the board. Pet care was no exception. Since then, it’s seen major growth, fueled by more people owning pets, the rise of online shopping, and shifting economic tides. Today, these markets are maturing—but still full of potential.

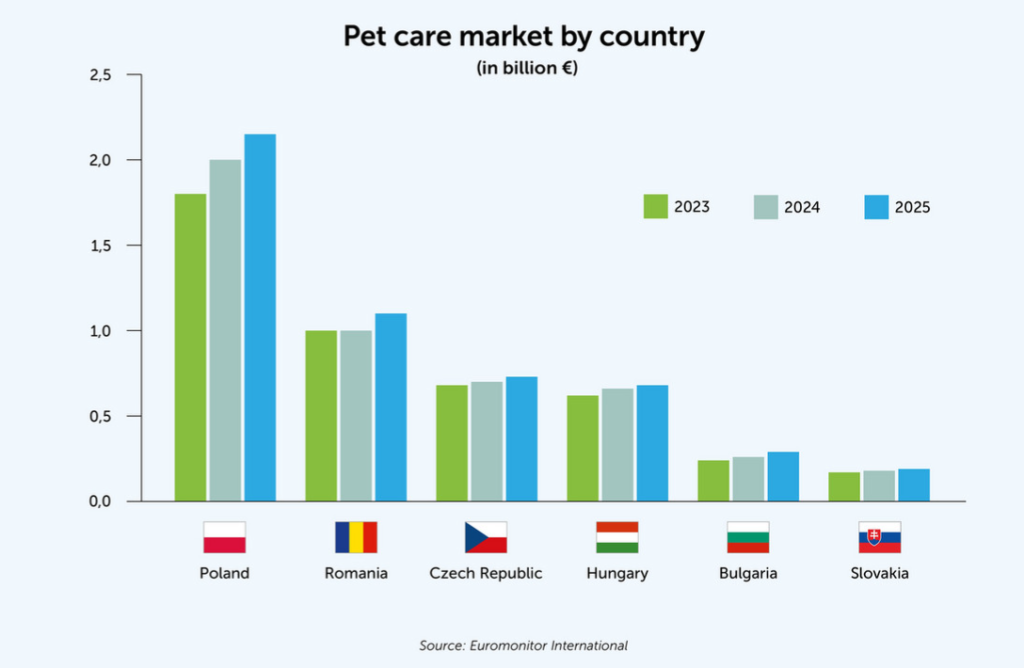

Poland: The CEE Pet Market Leader

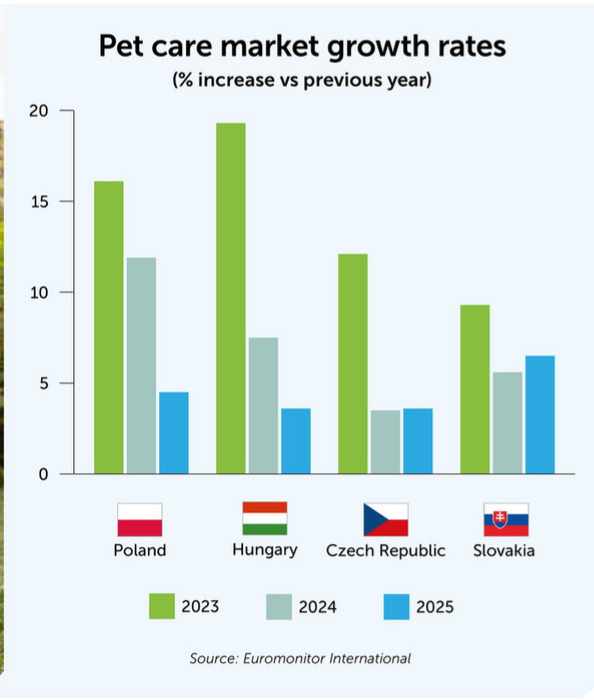

Poland’s size makes it the standout player in CEE’s #petindustry, and its trends often mirror those in Western Europe. The market has exploded in recent years, thanks to high pet ownership and a strong export sector. Per FEDIAF, the European pet food association, Poland’s #petfood market is currently worth around zł4.9 billion (€1.15B/$1.35B)—and it’s projected to grow 5-7% every year.

“It’s a market that just keeps growing,” says Maciej Przezdziak, General Secretary of Polkarma, Poland’s pet food manufacturers’ association. A big part of that growth comes from how many households have pets: 49% own at least one dog, and 40% have a cat. E-commerce is another driver—over 20% of pet care products are sold online, per Euromonitor, making Poland a regional leader in digital pet sales.

Consumers are also turning to private label #petproducts more and more. Amid inflation, these affordable options have seen a 3.7% jump in sales volume and a 5.1% boost in market share. Exports matter too: local pet food makers sell across the EU and to 63 other countries—another big boost for the market.

Why Poland Is a Production Hub

Poland’s also become a go-to spot for pet product manufacturing. “We have easy access to raw materials and workers, production costs are relatively low, and our location is great—so lots of companies have set up factories here,” Przezdziak explains. “We’re even seeing new factories in the works.”

An EU audit last year confirmed just how big Poland’s role is: it makes about 10% of all pet food sold in Europe. By the end of this year, Mordor Intelligence expects the market to hit €2.46 billion ($2.89B), with 7% annual growth—driven largely by demand for premium and sustainable products.

Online sales got a huge push from the pandemic, too. Marcin Kukla is CEO of Zoona.pl, an online #petretailer founded in 2015 in Katowice. “Before COVID, online pet product sales were growing, but after the pandemic hit? They took off way faster,” he says. His company has become a benchmark in the space, thanks in part to that digital boom.

The Marketplace Battle

Major online platforms are shaping Poland’s retail scene, though not always in ways sellers love. Allegro—Poland’s biggest e-commerce site, around since 1999—dominates, while Amazon entered more recently. “Marketplaces are great for buyers, but tough for sellers,” Kukla says. “The platform doesn’t care who’s selling—they just want the lowest price to attract customers, so they can take a cut from every sale.”

He doesn’t see Chinese players like Temu or AliExpress changing that much, though. “Polish #petowners want reliable products, especially when it comes to their pets’ health,” he notes. Amazon, however, might gain ground from a recent dispute between Allegro and nPost (leaders in the locker box market)—a gap Amazon could fill.

Hungary: High Pet Adoption, Shifting Spending

Hungary is CEE’s second-biggest #petmarket, and it’s easy to see why: 49% of households own a dog—the highest rate in the region, and one of the highest in all of Europe. Another 35% own a cat. This high adoption rate has pushed the #petindustry forward, with more owners shopping online for food and accessories than ever before.

This year, Hungary’s pet food market is expected to hit ft35.12 billion (€88.72M/$103.62M), per Statista—and it’s set to grow 4.05% annually through 2030. Spending on vet services and wellness products is up, but there’s a catch: Cofdis, a financial services firm, found pet care costs have risen 33% in the past five years, thanks to economic pressures.

Grooming, Boarding, and “Fur Family” Culture

For Peter Gardos, founder and CEO of Hungarian pet care company Dogmopolite, pets are now full-fledged family members—and that’s changing what owners buy. “More people are in single households, and pets play a bigger role there,” he says. “They get more attention, more affection, and people spend more on them. Pet care feels pretty recession-resistant, honestly.”

Dogmopolite’s growth tells that story. It started small: just one employee offering dog walking and daycare. Before long, they added a boarding in an apartment at Gardos’ grandmother’s villa in the Buda hills. By 2012, they’d outgrown that space (and another one) and opened their first large boarding facility in Budapest—then grooming salons, another boarding spot, and eventually a vet clinic and web shop. Today, they run 4 boarding/daycare centers (in Budapest and Debrecen), 4 grooming salons, a clinic, and an online store.

Inflation’s Hit on Premium Products

Peter Tamasi, CEO of PetPartners Hungary (one of the country’s top pet product distributors), has watched the market shift. “For years, CEE was Europe’s main growth driver for pet care—these markets grew way faster than Western Europe. Hungary was a big part of that,” he says.

COVID brought double-digit growth to Hungary’s pet market, but the war in Ukraine slowed things down. “Right now, there’s not much growth,” Tamasi admits. “In 2022-2023, Hungary’s inflation hit around 25%—one of the highest in Europe. Pet food inflation was even worse, between 40-50%.”

That’s changed how people shop for pets. “We saw a shift from premium to more affordable products,” Tamasi says. “Owners didn’t want to spend more, but they also weren’t getting the same quality for the money they used to.”

Czech Republic: Steady Growth, Slow and Steady

Compared to Poland and Hungary’s fast growth, the Czech Republic’s pet market is more stable, growing moderately even when the economy fluctuates. In 2025, the sector has seen steady value gains, thanks to an improving economy and falling inflation.

Pet care sales are up in both volume and value, and slightly lower unit prices have made products more accessible. A big trend? Specialized products: premium dog food, grooming items, and other gear that reflect how owners now see pets as family.

E-commerce is expanding, too, and private labels hold their own—over 30% of the market, per NielsenIQ. The market is expected to grow 5-6% annually this decade, driven by urbanization and a shift toward natural and organic pet products.

Of course, there are challenges. High retail prices and slower adoption rates in some segments could soften growth. But overall, the Czech Republic is a mature player in CEE—balancing traditional pet care habits with modern trends.

Slovakia: Natural Products and Cross-Border Ties

Slovakia’s pet market is on the rise, fueled by more people moving to cities and treating pets like family. In 2025, it’s worth around $40.34 million (€34.53M), and Statista projects 1.31% annual growth through 2029.

Dog food is the biggest segment, with owners leaning hard into natural and organic options. Household pet ownership is lower than in neighboring countries, but it’s growing—mostly for dogs and cats.

E-Commerce with a Personal Touch

Euromonitor says e-commerce and retail channels are key to Slovakia’s growth, with consumers seeking customized options like sustainably sourced food. COVID helped boost online shopping, says Ladislav Kobolka, CEO of COBBYS PET, a Slovakian #petstore chain that’s had an e-shop for years (alongside its physical stores).

“Our e-shop is a huge help for partners—they can order whenever it works for them, check new products, and see promotions,” Kobolka explains. “We use it to communicate with both wholesale partners and customers, too. It even helps our physical stores: people often look up our selection or deals before coming in.”

But he warns that e-shops need to be smart. “You have to own your warehouses and stock—overspending on ads without a solid revenue model is a recipe for failure,” he says. And while online shopping is popular, some customers still prefer in-store trips: “They want to touch products, feel them, and talk to staff.”

Cross-Border Culture (and VAT Headaches)

COBBYS PET’s story says a lot about Slovakia’s place in CEE. Kobolka’s dad opened an aquarium shop in 1989 (where Kobolka got his start), and in 2001, Kobolka launched his own company—now with 6 stores, 30+ employees, 500+ own products, and operations in Slovakia, the Czech Republic, and Hungary.

“The mentality in these three countries is so similar,” he says. “Cultural and ethical habits are the same—from a distance, it’s a really homogeneous part of Europe. People are nice, helpful, hospitable—we’re more alike than we think.”

The only big hurdle? VAT. “Czech Republic charges 12%, Slovakia 23%, Hungary 27%—that 15% gap messes with the market,” Kobolka says. “But when it comes to what people buy and how they see brands, these three markets are almost identical.”

The Big Takeaway: CEE Is More Alike Than Different

Poland, Hungary, the Czech Republic, and Slovakia each have their quirks—from Poland’s production power to Hungary’s high dog ownership—but they share core trends: pet humanization, growing e-commerce, and demand for quality (even as inflation hits budgets).

For brands looking to expand in Europe, CEE is a region worth watching. It’s not as saturated as Western Europe, and its similarities make it easier to scale across borders. Sure, challenges like VAT differences or market slowdowns exist—but the foundation for growth is strong. And as more owners treat their pets like family, this market will only get more important.

Source: GlobalPETS