America’s dual-income, no-kids (DINK) couples are feeling the pinch of today’s economy—higher prices, steeper interest rates, and all the rest. But there’s one area they refuse to cut back on: their pets.

A new survey from Insurify, the American insurance comparison site, lays it out clearly: 70% of DINKs are happy to make financial trade-offs to care for their furry friends—even if that means putting long-term savings or their own health coverage on the back burner.

The Numbers: How Much DINKs Spend on Pets

On average, these couples drop $158 (€135) a month on their pets—that’s roughly $1,906 (€1,634) a year. And it’s not just the basics: 87% cover food, 77% buy treats, 61% pick up toys, 47% pay for vet care, 35% handle medication, 28% splurge on grooming, and even 6% invest in pet tech like monitoring devices.

When it comes to #petfood, taste wins out. Half of DINKs prioritize their pet’s preferences (50%)—just barely above affordability (48%) and well ahead of allergy or medical needs (37%).

Vet Bills: A Big Cost (But Most Say It’s Worth It)

Routine costs aren’t the only worry. Vet bills alone have gone up 8% in the past year, so it’s no surprise 47% of DINKs set aside money for checkups regularly. Nearly half (45%) admit vet care is expensive—but say it’s totally worth it. Another 20%, though, say those bills cause real financial stress.

Who These Pet Parents Are

Insurify’s survey talked to 750 DINKs between 22 and 44 years old (polled in March 2025), all of whom have at least one cat or dog. Here’s a quick snapshot:

- Pet counts: 60% have 1 dog, 28% have 2 dogs; 48% have 1 cat, 35% have 2 cats.

- Top dog breeds: Chihuahuas (14%), German Shepherds (11%), and Labrador Retrievers (11%) are the most popular.

- How they see their pets: 46% see their pets as “fur babies,” 38% as full-on family members, and 14% as loyal companions or friends. And 81% call themselves their pet’s “mom” or “dad.”

- Extra touches: More than half of respondent dress their pets in clothes or costumes.

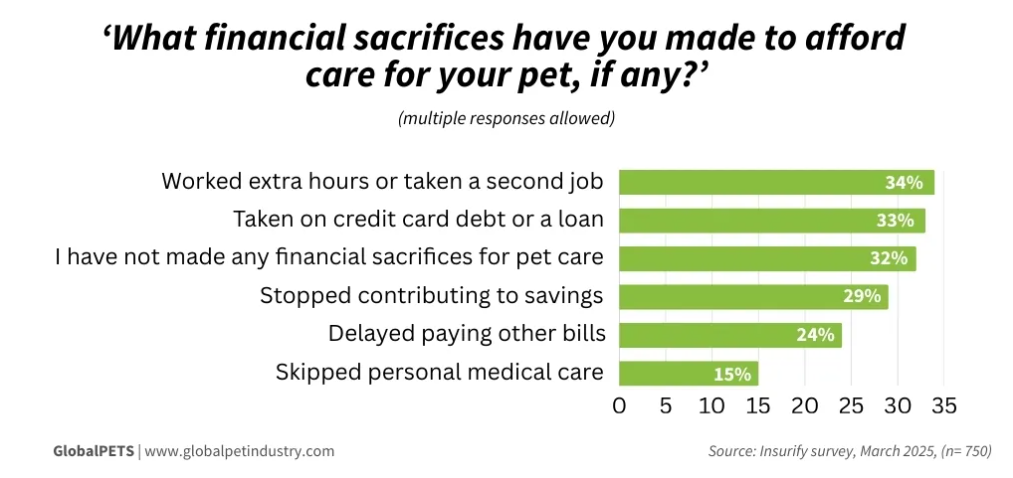

The Sacrifices They’re Willing to Make

To keep up with rising pet costs, 68% of these DINKs are making real, sometimes tough sacrifices:

- 34% say they’ve picked up extra work or a side hustle.

- 33% have turned to credit cards or loans to cover pet expenses.

- 29% stopped putting money into their savings.

- 15% even delayed their own medical care to prioritize their pets.

The Pet Insurance Gap: Willing to Spend, But Not Prepared

DINKs love their pets enough to pay up for life-saving care—they say they’d spend up to $5,004 on emergency treatment. But here’s the catch: 36% admit they couldn’t cover a surprise vet bill if it popped up. And 70% have already dealt with unexpected pet costs.

Yet #petinsurance is still underused. Only 31% of respondents have it. Even among the 68% who say they’d go into debt for a pet emergency, most would reach for credit cards (21%) or savings (27%) before relying on insurance. That’s despite average monthly premiums being relatively manageable: around $44 (€38) for dogs and $24 (€21) for cats.

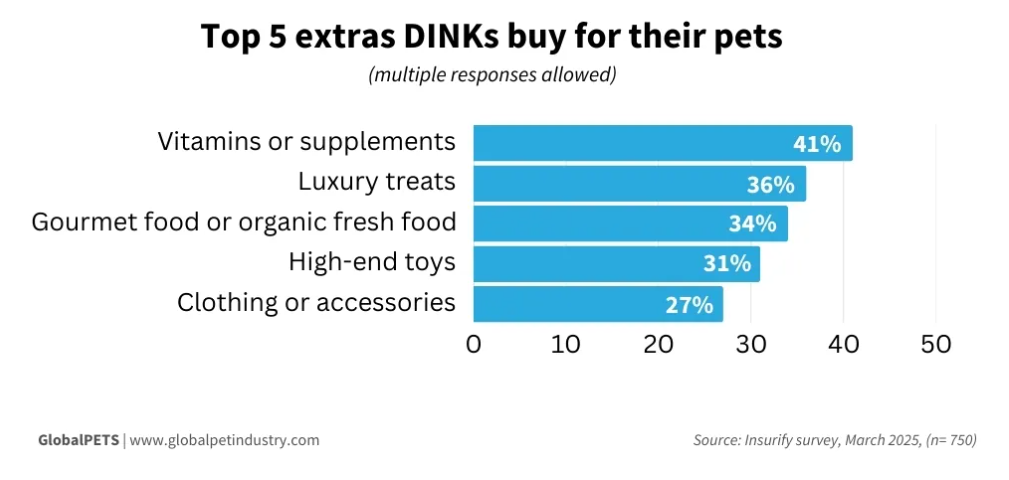

Spoiling Their Furry Family: More Than Just Essentials

For most DINKs, “taking care of pets” means more than just covering food and vet visits—they go all in on spoiling them:

- 11% never splurge on extras, but 43% occasionally buy luxury treats or high-end toys.

- 26% regularly spoil their pets without even tracking how much they spend.

- A whopping 68% say they prefer pets to kids (though 39% still plan to have children someday).

For now, though, they’re leaning into the perks of prioritizing pets: more financial freedom, lower costs than raising kids, and tons of emotional fulfillment. And the little luxuries? They’re part of the fun. 94% treat their pets like people—86% let them sleep in the bed, 65% leave music or TV on when they’re out, and 43% even throw birthday parties for their furry friends.

At the end of the day, these DINK couples are redefining what “family” means— and their pets are right at the center of it, even if it means stretching the budget a little (or a lot).

Source: GlobalPETS