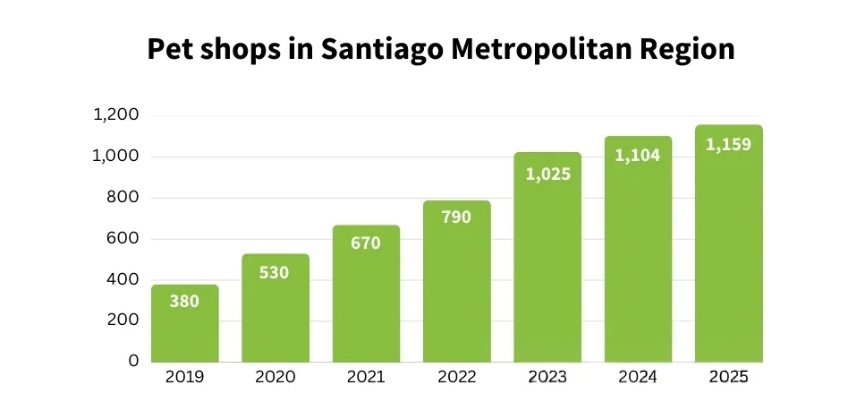

On the streets of Santiago, Chile’s capital, #petshops are springing up like mushrooms. According to the latest research data from real estate consulting firm Colliers, the number of pet shops in the city has surged from 530 in 2020 to 1,159 in 2025—more than doubling in just five years.

This growth is driven by young families and the rising trend of #pethumanization among owners. Analysts believe Chile’s #petmarket is booming with room for further expansion, offering significant potential business opportunities.

1. Market Overview: The Rise of Chile’s “Pet Economy”

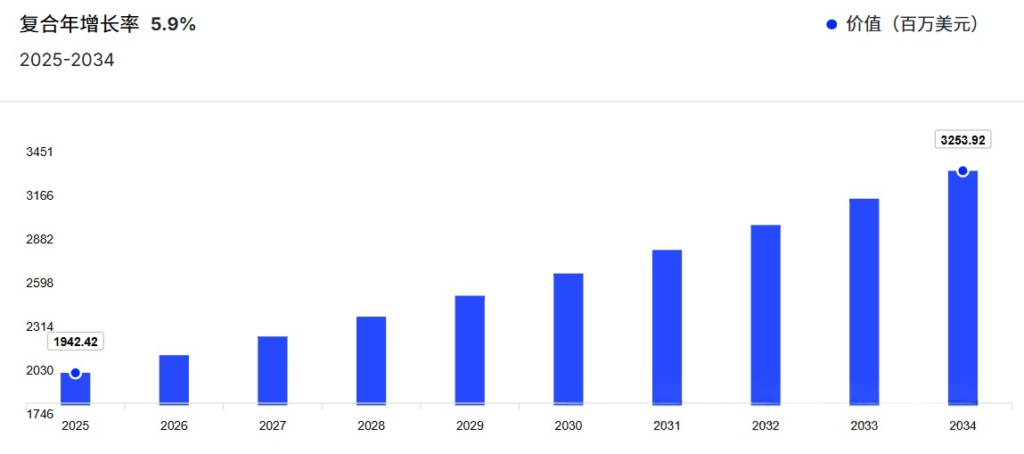

Chile’s pet market is experiencing unprecedented growth. Per a report from Expert Market Research, the Chilean #petcare market was valued at approximately $1.8342 billion in 2024 and is projected to grow to $3.25392 billion by 2034, with a compound annual growth rate (CAGR) of 5.90%.

This growth isn’t just reflected in numbers—it’s also visible in the commercial landscape of Chile’s cities. Nationwide, the number of pet shops and related services has increased by 35% over the past four years, rising from 2,500 to nearly 3,400.

The foundation driving this growth is Chile’s large #petpopulation. Chile’s government released its first pet population study in 2022, revealing 12,482,679 owned dogs and cats, plus 4,049,277 unattended pets (i.e., those with no known or visible owner). Analysts link the rise in #petownership to Chile’s declining birth rate, which hit a historic low in 2023.

2. Market Drivers: Pet Humanization & Consumption Upgrade

Chile’s pet market boom stems from the combined influence of social and economic factors — with pet humanization at its core.

Pet humanization, especially among young families, has become a key trend. José Ignacio Arteaga, Business Intelligence Manager at Colliers Chile, notes that this shift has expanded #petowners’ spending “beyond food to include clothing, accessories, and medications.”

Purchasing power is another critical factor. Chile ranks among the countries with the highest GDP per capita in South America. Juan Pablo Martínez, CEO of distributor Ludipek, shares: “In Chile, annual per capita spending on pets exceeds $80—far higher than in Brazil or Mexico.”

Daniel Encina, CEO of Xbrein, interprets this consumption shift as a “redistribution of goods in Chilean society”: “In certain age groups, resources that were once allocated to children’s products and services are now being redirected to pets.”

The expansion of e-commerce has also accelerated market penetration. Pet owners are increasingly buying #petcareproducts online, while businesses are building brand loyalty through subscription models and personalized packaging.

3. Channel Transformation: Omnichannel Integration & Specialized Services

Chile’s pet market is undergoing a profound channel transformation, with three notable trends emerging:

Trend 1: Refined Offline Channels

Pet shops are no longer just places to sell products—they’re increasingly integrating comprehensive services like in-store clinics, grooming, and boarding. This “service + retail” model caters to modern pet owners’ demand for one-stop solutions.

Trend 2: Rapid Growth of E-Commerce

Data from a Chinese e-commerce platform shows that Chile’s procurement volume of smart #petproducts has increased by 70%. Cross-border e-commerce platforms have become key bridges connecting suppliers to Chilean buyers.

Trend 3: Rise of Omnichannel Strategies

As consumers stay highly connected, Chilean distributors are adjusting their operations—expanding logistics coverage, professionalizing inventory management, and collaborating more closely with retailers. Distributors like Ludipek have emphasized that “omnichannel strategies are gaining more attention.”

4. Policy Environment: Impact of Technical Trade Measures

#Petbusinesses considering entry into the Chilean market—especially those in the food sector—need to closely monitor Chile’s evolving import regulations.

In August 2025, Chile’s Ministry of Agriculture plans to revise the standards for international veterinary certificates for imported animal products. The new rules will require certificates to include specific hygiene requirements set by the Ministry, issued by the competent veterinary authority of the country of origin. Certificates must be issued in Spanish and the official language of the country of origin, with the original document signed by an official veterinarian and stamped by the competent veterinary authority. Additionally, certificate validity varies by transport method: 10 days for land or air transport, and 30 days for sea transport.

As early as July 2024, Chile issued a notice proposing revisions to the import hygiene requirements for animal-derived products and live animals, stipulating that products exported to Chile must come from disease-free countries, regions, or quarantine zones. These policy changes place higher demands on export enterprises, which need to prepare in advance to meet compliance standards.

5. Opportunities & Challenges for Pet Businesses Going Global

Based on the characteristics of Chile’s pet market, pet enterprises face multiple business opportunities:

Opportunity 1: Huge Potential for Smart Pet Products

Data from a Chinese e-commerce platform shows strong demand in Chile for smart pet bowls—especially those with APP-enabled scheduled feeding.

Opportunity 2: Market Gaps for Differentiated Products

Chilean pet owners are paying more attention to the ingredient lists of #petfood and showing a preference for refrigerated and frozen options. This creates opportunities for enterprises to develop high-quality, specialized pet food.

Opportunity 3: E-Commerce Lowers Entry Barriers

#Petbrands can directly reach Chilean consumers via cross-border e-commerce platforms, testing market response without heavy asset investment.

However, challenges in Chile’s pet market cannot be ignored:

Challenge 1: Brand Building Is Critical

Industry insiders point out that “the line between overseas-going brands and domestic no-name brands is subtle in the eyes of foreign consumers. The key issue isn’t price or quality—it’s that brand storytelling, cultural recognition, and local emotional connection require long-term cultivation.”

Challenge 2: Logistics & After-Sales Are Hard Requirements

One brand once faced cash flow problems because shipping to Amazon warehouses in the U.S. took as long as 3 to 3.5 months. This ultimately forced it to close factories and lay off employees. The case serves as a reminder for overseas-going enterprises to plan for overseas warehousing or FBA (Fulfillment by Amazon) services.

Challenge 3: Compliance Risks Require Professional Handling

Chile has strict and evolving regulations for imported animal-derived products. Enterprises must therefore have the ability to navigate complex compliance requirements.

6. Final Thoughts

Chile’s pet market growth curve is expected to flatten in the future—but become more sustainable. As the market matures and consolidates, true competition will shift toward brand building, product differentiation, and omnichannel operation capabilities. Pet businesses willing to invest in localization and compliance, Chile remains a promising market worth exploring.