Why affordability is becoming a critical growth constraint

Australia remains one of the world’s most pet-loving countries, with more animals living in households than ever before. The #petindustry now generates more than A$21 billion annually, reflecting strong long-term demand.

However, recent data shows that rising costs are becoming a structural barrier—both for households considering #petownership and for existing #petowners trying to maintain the same level of care.

According to Pets in Australia: A National Survey of Pets and People released by Animal Medicines Australia (AMA), financial pressure is now the single biggest factor limiting future growth in pet ownership.

Pet ownership is still growing—but cost concerns are growing faster

The survey indicates that pet penetration in Australian households increased by 4 percentage points over the past three years. Looking ahead, demand remains strong:

- 700,000 households without pets are actively considering getting one

- 30% of current pet owners (around 3.2 million households) are interested in adding another pet

Over the same three-year period, the Australian pet industry expanded by 35%, while the overall pet population grew by 10%.

Yet behind this growth sits a growing affordability gap.

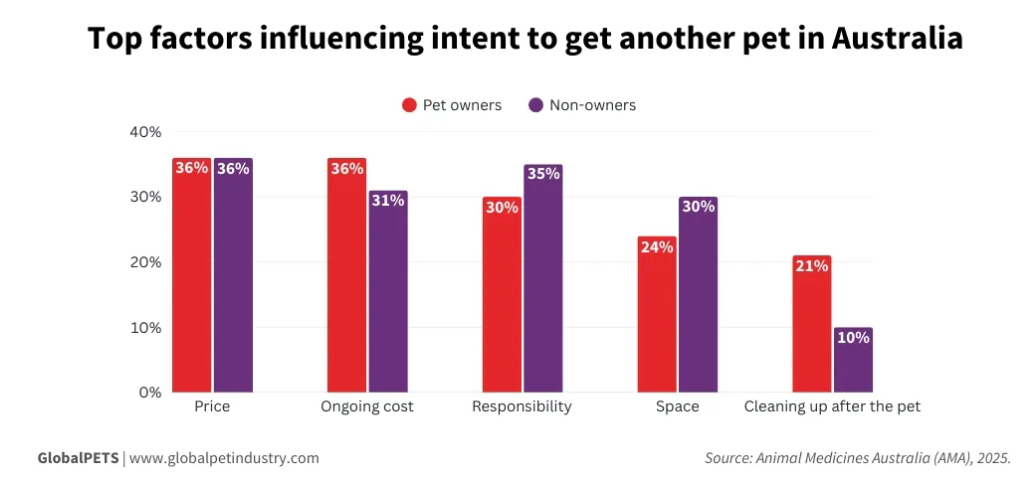

Cost is now the main barrier for potential pet owners

Among households considering pet ownership, concerns are increasingly financial:

- 36% worry about the upfront cost of acquiring a pet

- 35% are concerned about ongoing care expenses

- 30% cite the responsibility involved

These concerns are particularly pronounced among lower-income families and households facing financial vulnerability. For these groups, rising #petcare costs are no longer a minor consideration—they are often decisive.

Existing pet owners are also feeling the strain

Financial pressure is not limited to first-time pet owners. The report shows a steady increase in cost-related challenges among existing owners:

- 82% now report experiencing at least some financial difficulty in caring for their pets

- This compares with 79% in 2022 and 66% in 2019

Importantly, 32% of current pet owners now identify costs as a constraint, up sharply from 24% in 2022.

Spending adjustments are affecting care decisions

While the percentage of families requiring assistance with #pethealthcare remains relatively low overall (12%), certain groups are disproportionately affected:

- Families with children under 18: 18%

- Households facing higher financial vulnerability: 18%

In response to rising costs, some owners are making difficult trade-offs. The report notes reduced veterinary visits due to consultation fees, medication costs and procedure expenses. In some cases, vaccinations are delayed or skipped altogether.

More concerningly, 18% of cat owners and 14% of dog owners reported more extreme measures, including skipping routine check-ups, reducing or stopping medication, or administering medicines intended for humans.

Pet food purchasing behavior is also shifting

Cost pressure is clearly influencing purchasing patterns in the #petfood category. To manage expenses, owners are increasingly:

- Choosing lower-priced food options

- Buying in bulk

- Switching to more affordable brands

These changes suggest that value perception—rather than premium positioning alone—is becoming increasingly important in the Australian market.

What this means for pet brands

The Australian market highlights a broader global reality: emotional attachment to pets remains strong, but affordability is becoming a decisive factor.

For #petbrands, growth is no longer just about expanding the category. It increasingly depends on how effectively products balance quality, functionality and perceived value—especially as consumers reassess what they can realistically afford.

What this means for pet brands working with OEM partners

For brands relying on OEM manufacturing, rising cost sensitivity changes the conversation:

- Product design needs to focus on functional value, not unnecessary complexity

- Material choices, construction methods and packaging must support cost-efficiency without compromising safety

- OEM partners with flexible production capabilities can help brands respond faster to shifting price expectations

In markets like Australia, the brands that perform best will likely be those that align product development, pricing strategy and manufacturing decisions early—rather than treating cost pressure as a downstream problem.

Source: GlobalPETS