A snapshot of the #petindustry in Thailand in 2025, featuring the most recent statistics and trends.

Thailand’s pet industry is expanding at a remarkable pace. The country ranks as the world’s second-largest pet food exporter and is projected to take the top spot within 5 years.

Pet population

The pet population in Thailand has been steadily growing. The Faculty of Veterinary Medicine at Kasetsart University’s second survey of 2024 reported a total of 5.08 million pets, representing an 8% increase compared to 2023.

Thai #petowners are also investing more in their pets, with many spending between $300 (€275) and $600 (€550) annually, particularly on grooming services. On average, Thai pet owners spend $4.25 (€4.07) per shopping trip, with dog owners leading in spending.

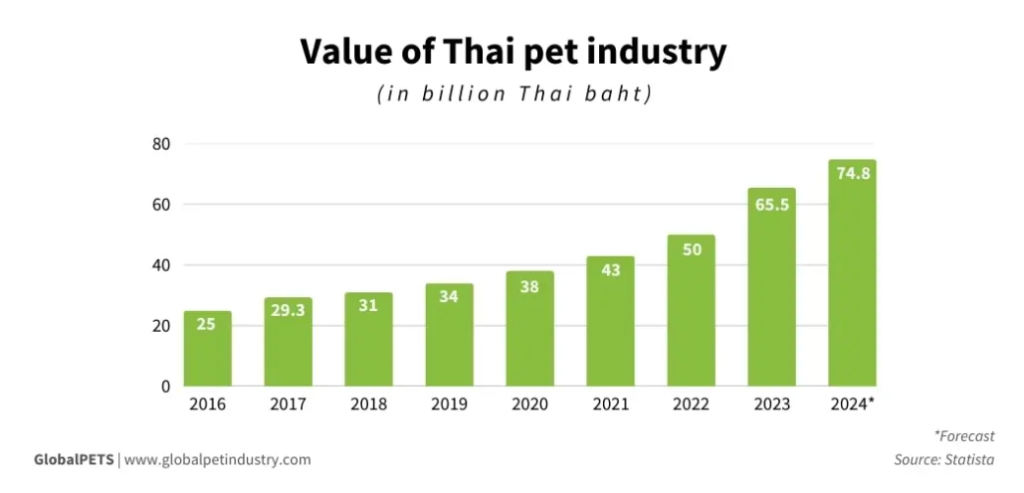

Pet industry in Thailand

Thailand has the largest #petcare market in Southeast Asia, valued at $1.5 billion (€1.4B) in 2023, accounting for nearly half of the region’s total market.

According to Euromonitor International, it is among the fastest-growing pet care markets in the Asia-Pacific region, with a projected 8.7% growth rate by 2029.

En route to becoming the world’s largest pet food exporter

As of 2024, Thailand ranks as the world’s second-largest #petfood exporter, with projections of the country becoming the global leader within 5 years. Its pet food exports are expected to reach $2.5 billion (€2.4B) in 2024, reflecting steady annual growth. Despite a slight decline in 2023, Thailand’s pet food industry has solidified its position as a global leader.

Thailand benefits from low production costs, trade agreements with 15 countries and a well-established manufacturing sector. Continued investment in product development and production capacity is expected to support its growing role in the region’s $29 billion (€27.8B) pet care industry.

Thai pet food exports have found strong demand across Asia. In India, imports from Thailand have grown sixfold over the past decade. In Taiwan, Thailand is the leading supplier, playing a key role in meeting the rising demand for premium pet food. Despite increasing local production in South Korea, Thailand still holds a significant market share in both value and volume.

However, regulatory challenges have emerged in some markets. A U.S. export ban over labor concerns has put pressure on Thailand’s $1 billion (€957.2M) market there, while Canada has introduced stricter rules on non-canned pet food imports.

Despite these hurdles, Thailand’s established export infrastructure and manufacturing capabilities position it well to expand in global markets where demand for pet food continues to grow.

Retail landscape

Thailand’s #petretail industry is growing, with both physical stores and e-commerce playing key roles. Pet Lovers Centre has 130 new store openings planned, while online sales now account for 18% of revenue, with over 22% of purchases delivered to customers’ homes.

Online platforms such as Lazada Thailand and Tops Online are important players. TikTok Shop is also gaining traction, allowing #petbrands to engage customers through live shopping and shoppable videos.

Sustainability

Sustainability is becoming a growing consideration among Thai pet owners, reflecting broader regional trends. According to Euromonitor, 68.3% of pet owners in Asia Pacific believe their actions positively impact the environment.

Thailand, identified as one of the fastest-growing pet markets through 2029, is seeing increased interest in products with sustainability-related claims, such as “natural” and “organic,” a trend that may influence future demand and product development.

Opportunities

With a growing pet population and increasing focus on quality, Thailand is emerging as Southeast Asia’s pet care powerhouse. Demand for premium pet food and sustainability initiatives is rising alongside the rapid expansion of online and in-store retail. As international companies invest in manufacturing and exports continue to grow, the industry is set for sustained expansion.

Source:GLobaLPETS

2 Responses

F*ckin’ awesome things here. I am very satisfied to see your article. Thank you a lot and i’m looking ahead to touch you. Will you please drop me a mail?

Thank you! What can I do for you?